Question

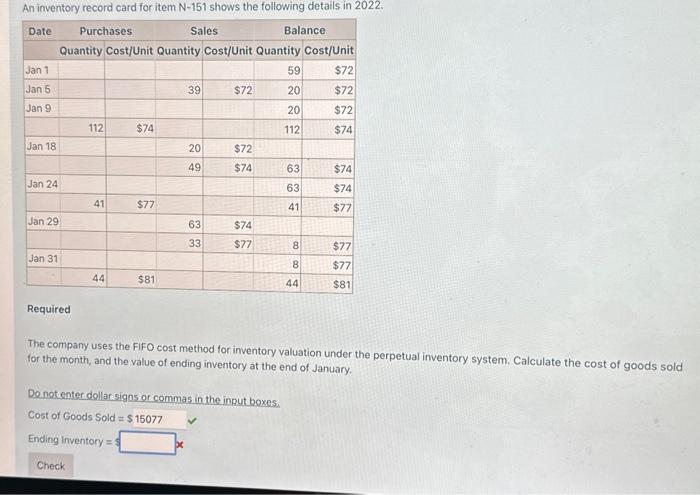

An inventory record card for item N-151 shows the following details in 2022. Date Purchases Sales Jan 1 Jan 5 Jan 9 Jan 18

An inventory record card for item N-151 shows the following details in 2022. Date Purchases Sales Jan 1 Jan 5 Jan 9 Jan 18 Jan 24 Jan 29 Jan 31 Quantity Cost/Unit Quantity Cost/Unit Quantity Cost/Unit 59 $72 $72 $72 $74 112 41 44 $74 $77 $81 39 20 49 63 33 $72 $72 $74 $74 $77 Balance Do not enter dollar signs or commas in the input boxes. Cost of Goods Sold = $15077 Ending Inventory = Check 220 112 63 63 41 8 8 44 $74 $74 $77 $77 $77 $81 Required The company uses the FIFO cost method for inventory valuation under the perpetual inventory system. Calculate the cost of goods sold for the month, and the value of ending inventory at the end of January.

Step by Step Solution

3.49 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

The following are the calculations for the cost of goods sold and the value of endi...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Income Tax Fundamentals 2013

Authors: Gerald E. Whittenburg, Martha Altus Buller, Steven L Gill

31st Edition

1111972516, 978-1285586618, 1285586611, 978-1285613109, 978-1111972516

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App