Answered step by step

Verified Expert Solution

Question

1 Approved Answer

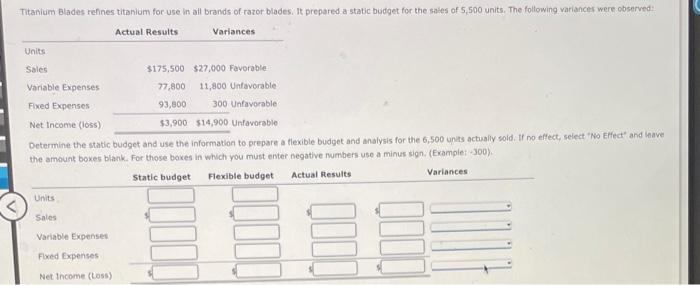

Titanium Blades refines titanium for use in all brands of razor blades. It prepared a static budget for the sales of 5,500 units. The

Titanium Blades refines titanium for use in all brands of razor blades. It prepared a static budget for the sales of 5,500 units. The following variances were observed: Actual Results Variances Units Sales $175,500 $27,000 Favorable Variable Expenses 77,800 11,800 Unfavorable 300 Unfavorable Fixed Expenses 93,800 Net Income (loss) $3,900 $14,900 Unfavorable Determine the static budget and use the information to prepare a flexible budget and analysis for the 6,500 units actually sold. If no effect, select "No Effect and leave the amount boxes blank. For those boxes in which you must enter negative numbers use a minus sign. (Example: -300). Static budget Flexible budget Actual Results Variances Units Sales Variable Expenses Fixed Expenses Net Income (Loss)

Step by Step Solution

★★★★★

3.40 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

The image shows a budget analysis exercise where Titanium Blades prepared a static budget based on an expected sale of 5900 units and the actual results and variances for the real units sold which wer...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started