Answered step by step

Verified Expert Solution

Question

1 Approved Answer

An investment advisor has presented you with the following proposal: Purchase an investment with an immediate cash payment and then expect to receive a

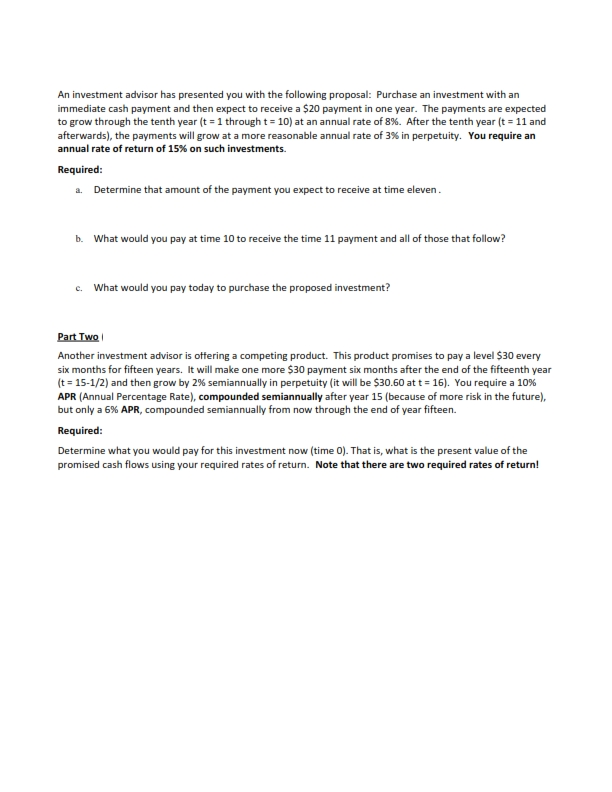

An investment advisor has presented you with the following proposal: Purchase an investment with an immediate cash payment and then expect to receive a $20 payment in one year. The payments are expected to grow through the tenth year (t = 1 through t = 10) at an annual rate of 8%. After the tenth year (t = 11 and afterwards), the payments will grow at a more reasonable annual rate of 3% in perpetuity. You require an annual rate of return of 15% on such investments. Required: a. Determine that amount of the payment you expect to receive at time eleven. b. What would you pay at time 10 to receive the time 11 payment and all of those that follow? c. What would you pay today to purchase the proposed investment? Part Two Another investment advisor is offering a competing product. This product promises to pay a level $30 every six months for fifteen years. It will make one more $30 payment six months after the end of the fifteenth year (t = 15-1/2) and then grow by 2% semiannually in perpetuity (it will be $30.60 at t = 16). You require a 10% APR (Annual Percentage Rate), compounded semiannually after year 15 (because of more risk in the future), but only a 6% APR, compounded semiannually from now through the end of year fifteen. Required: Determine what you would pay for this investment now (time 0). That is, what is the present value of the promised cash flows using your required rates of return. Note that there are two required rates of return!

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Part One Investment Proposal 1 a Payment at Time Eleven This is a perpetuity with a growth rate g of 3 and a required return r of 15 Using the perpetu...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started