Answered step by step

Verified Expert Solution

Question

1 Approved Answer

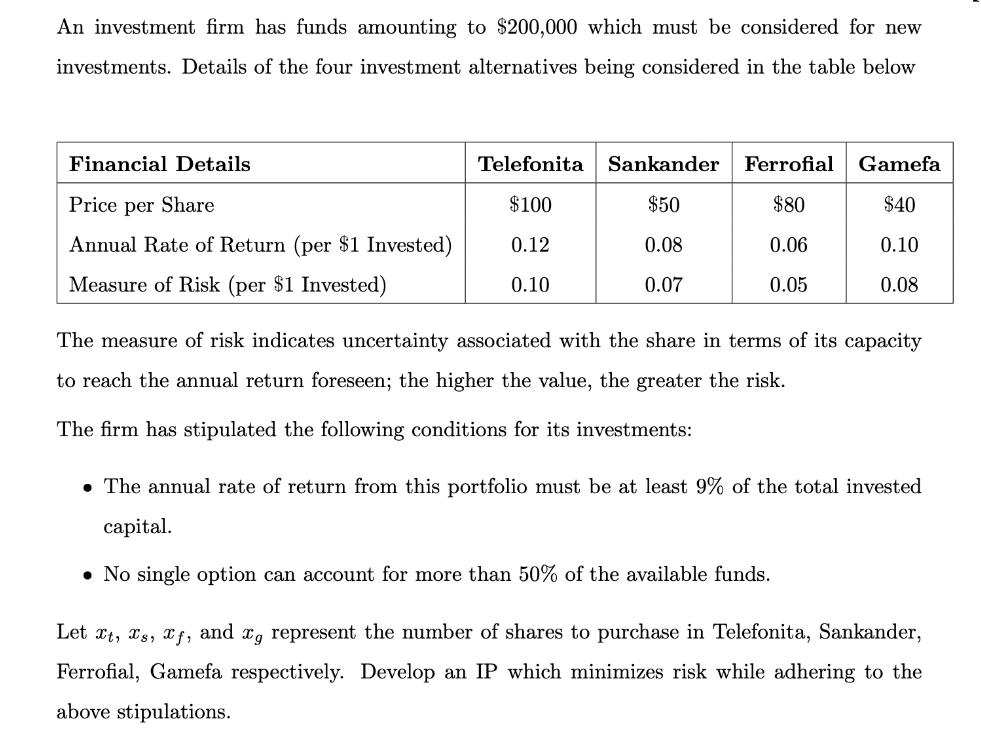

An investment firm has funds amounting to $200,000 which must be considered for new investments. Details of the four investment alternatives being considered in

An investment firm has funds amounting to $200,000 which must be considered for new investments. Details of the four investment alternatives being considered in the table below Financial Details Price per Share Annual Rate of Return (per $1 Invested) Measure of Risk (per $1 Invested) Telefonita Sankander Ferrofial Gamefa $100 $50 $80 $40 0.12 0.08 0.06 0.10 0.10 0.07 0.05 0.08 The measure of risk indicates uncertainty associated with the share in terms of its capacity to reach the annual return foreseen; the higher the value, the greater the risk. The firm has stipulated the following conditions for its investments: The annual rate of return from this portfolio must be at least 9% of the total invested capital. No single option can account for more than 50% of the available funds. Let xt, xs, xf, and xg represent the number of shares to purchase in Telefonita, Sankander, Ferrofial, Gamefa respectively. Develop an IP which minimizes risk while adhering the above stipulations.

Step by Step Solution

★★★★★

3.46 Rating (172 Votes )

There are 3 Steps involved in it

Step: 1

To formulate an integer programming IP problem for minimizing risk while adhering to the stipulated ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started