Answered step by step

Verified Expert Solution

Question

1 Approved Answer

An investment firm is considering a portfolio of Stocks RCB and BSN . The firm has a total of $ 2 0 , 0 0

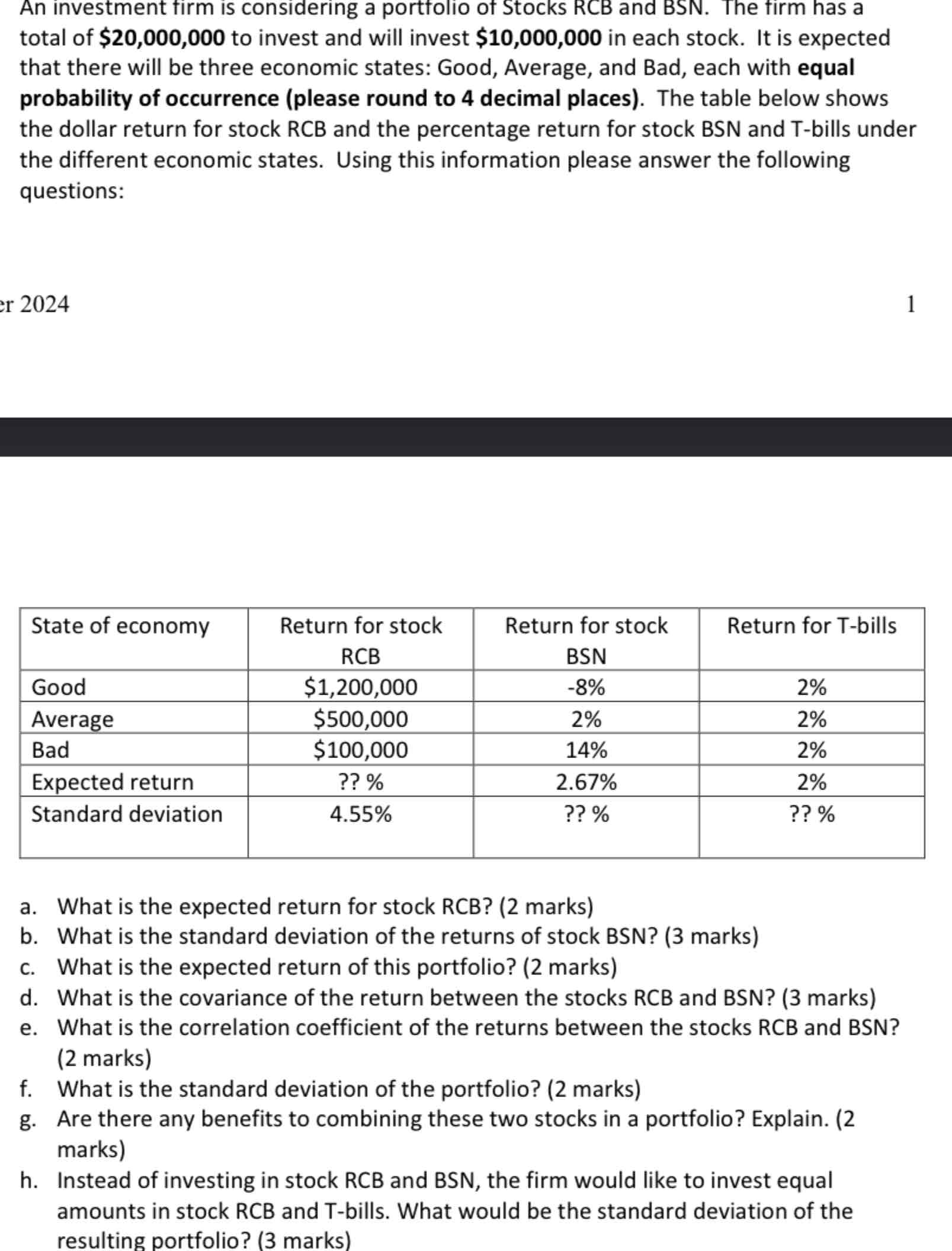

An investment firm is considering a portfolio of Stocks RCB and BSN The firm has a

total of $ to invest and will invest $ in each stock. It is expected

that there will be three economic states: Good, Average, and Bad, each with equal

probability of occurrence please round to decimal places The table below shows

the dollar return for stock RCB and the percentage return for stock BSN and Tbills under

the different economic states. Using this information please answer the following

questions:

a What is the expected return for stock RCB marks

b What is the standard deviation of the returns of stock BSN marks

c What is the expected return of this portfolio? marks

d What is the covariance of the return between the stocks RCB and BSN marks

e What is the correlation coefficient of the returns between the stocks RCB and BSN

marks

f What is the standard deviation of the portfolio? marks

g Are there any benefits to combining these two stocks in a portfolio? Explain.

marks

h Instead of investing in stock RCB and BSN the firm would like to invest equal

amounts in stock RCB and Tbills. What would be the standard deviation of the

resulting portfolio? marks

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started