Answered step by step

Verified Expert Solution

Question

1 Approved Answer

An investment fund, P, generates a return of 30% in 2006 and 20% in 2007 . The beta of P, the risk-free rate and the

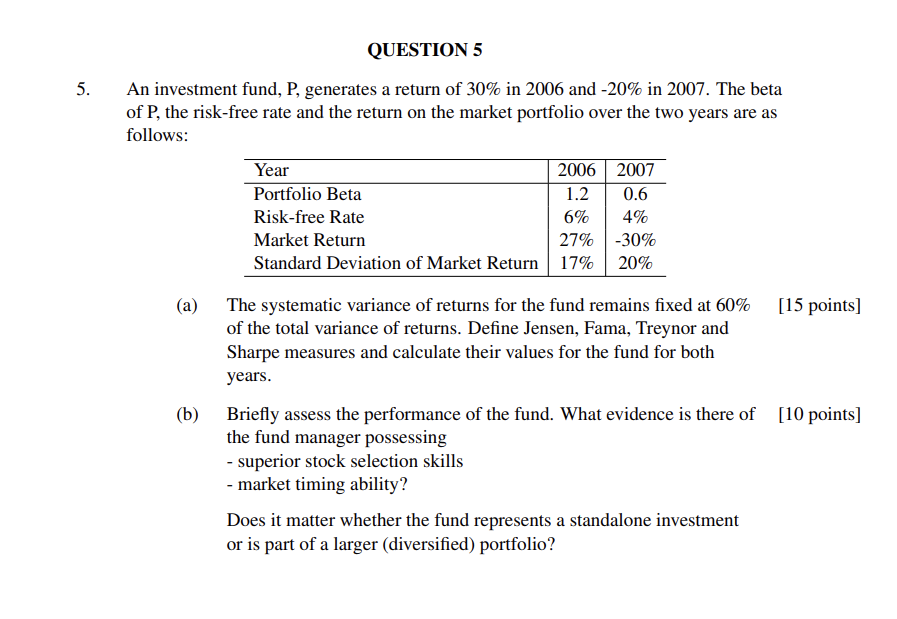

An investment fund, P, generates a return of 30% in 2006 and 20% in 2007 . The beta of P, the risk-free rate and the return on the market portfolio over the two years are as follows: (a) The systematic variance of returns for the fund remains fixed at 60% [15 points] of the total variance of returns. Define Jensen, Fama, Treynor and Sharpe measures and calculate their values for the fund for both years. (b) Briefly assess the performance of the fund. What evidence is there of [10 points] the fund manager possessing - superior stock selection skills - market timing ability? Does it matter whether the fund represents a standalone investment or is part of a larger (diversified) portfolio

An investment fund, P, generates a return of 30% in 2006 and 20% in 2007 . The beta of P, the risk-free rate and the return on the market portfolio over the two years are as follows: (a) The systematic variance of returns for the fund remains fixed at 60% [15 points] of the total variance of returns. Define Jensen, Fama, Treynor and Sharpe measures and calculate their values for the fund for both years. (b) Briefly assess the performance of the fund. What evidence is there of [10 points] the fund manager possessing - superior stock selection skills - market timing ability? Does it matter whether the fund represents a standalone investment or is part of a larger (diversified) portfolio Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started