Answered step by step

Verified Expert Solution

Question

1 Approved Answer

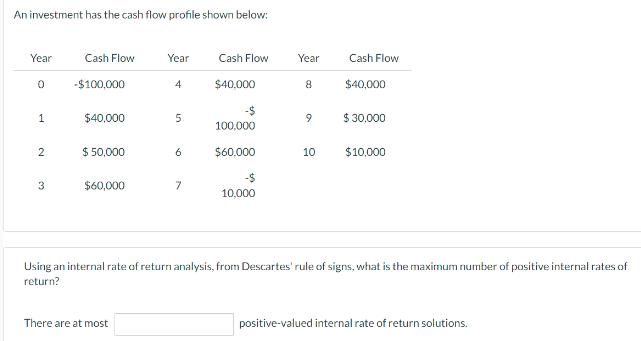

An investment has the cash flow profile shown below: Year 0 1 2 3 Cash Flow -$100,000 $40,000 $ 50,000 $60,000 Year Cash Flow

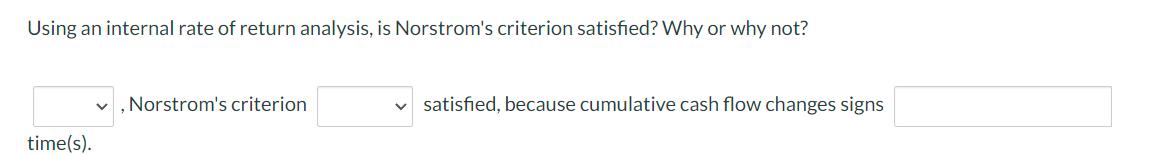

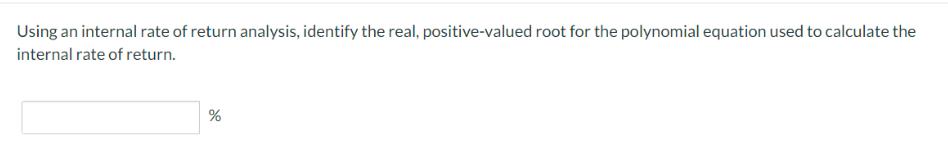

An investment has the cash flow profile shown below: Year 0 1 2 3 Cash Flow -$100,000 $40,000 $ 50,000 $60,000 Year Cash Flow 4 $40,000 There are at most 5 6 7 -$ 100,000 $60,000 -$ 10,000 Year 8 9 10 Cash Flow $40,000 $ 30,000 $10,000 Using an internal rate of return analysis, from Descartes' rule of signs, what is the maximum number of positive internal rates of return? positive-valued internal rate of return solutions. Using an internal rate of return analysis, is Norstrom's criterion satisfied? Why or why not? time(s). , Norstrom's criterion satisfied, because cumulative cash flow changes signs Using an internal rate of return analysis, identify the real, positive-valued root for the polynomial equation used to calculate the internal rate of return. %

Step by Step Solution

★★★★★

3.36 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

To determine the maximum number of positive internal rates of return IRR ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started