Answered step by step

Verified Expert Solution

Question

1 Approved Answer

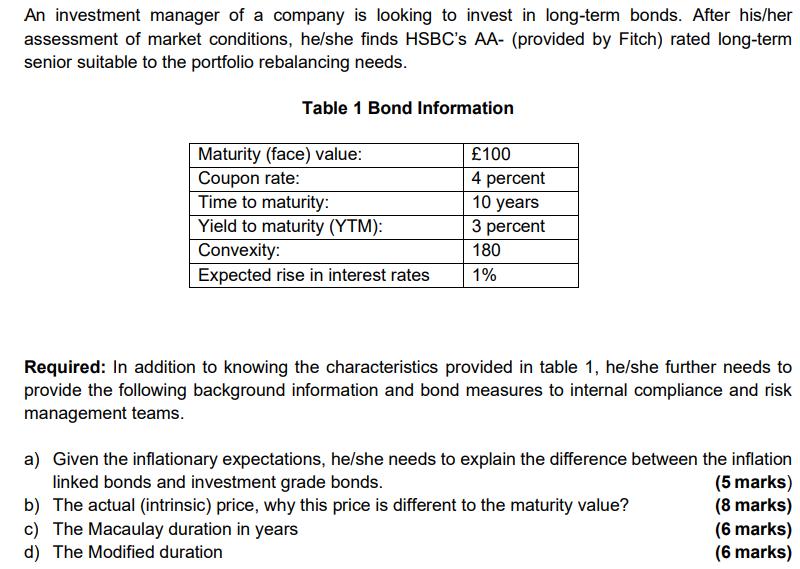

An investment manager of a company is looking to invest in long-term bonds. After his/her assessment of market conditions, he/she finds HSBC's AA- (provided

An investment manager of a company is looking to invest in long-term bonds. After his/her assessment of market conditions, he/she finds HSBC's AA- (provided by Fitch) rated long-term senior suitable to the portfolio rebalancing needs. Table 1 Bond Information Maturity (face) value: Coupon rate: Time to maturity: Yield to maturity (YTM): Convexity: Expected rise in interest rates 100 4 percent 10 years 3 percent 180 1% Required: In addition to knowing the characteristics provided in table 1, he/she further needs to provide the following background information and bond measures to internal compliance and risk management teams. a) Given the inflationary expectations, he/she needs to explain the difference between the inflation linked bonds and investment grade bonds. (5 marks) (8 marks) b) The actual (intrinsic) price, why this price is different to the maturity value? c) The Macaulay duration in years d) The Modified duration (6 marks) (6 marks)

Step by Step Solution

★★★★★

3.38 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

a Explanation of the difference between inflationlinked bonds and investment grade bonds Inflationlinked bonds and investmentgrade bonds are two different types of fixedincome securities Inflationlink...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started