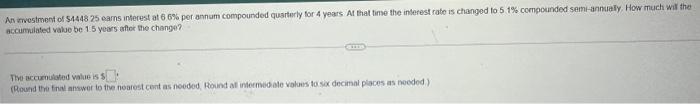

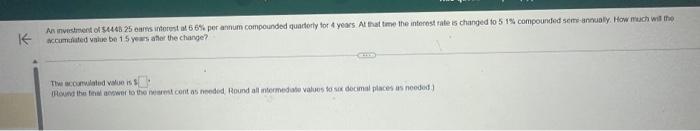

An investment of $4448.25 earns interest at 6.6% per annum compounded quarterly for 4 years. At that time the interest rate is changed to 5.1% compounded semi-annually. How much will the accumulated value be 1.5 years after the change? - The accumulated value is $ (Round the final answer to the nearest cent as needed, Round all intermediate values to six decimal places as needed.)

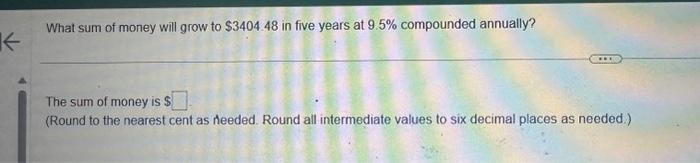

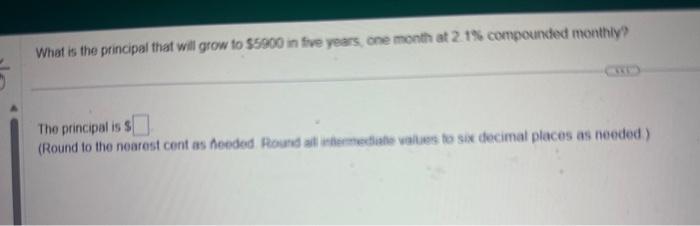

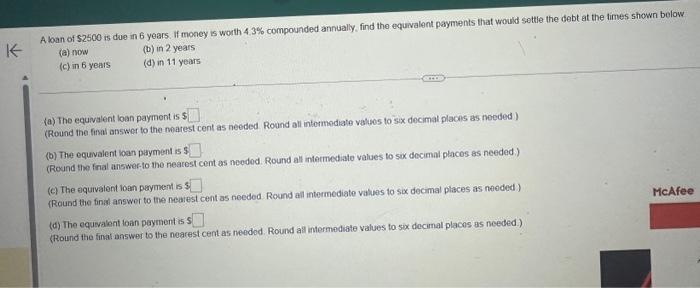

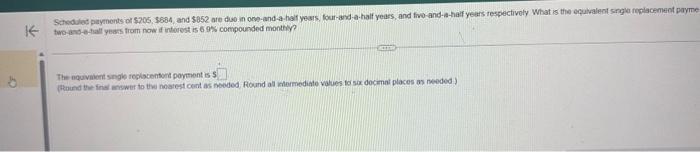

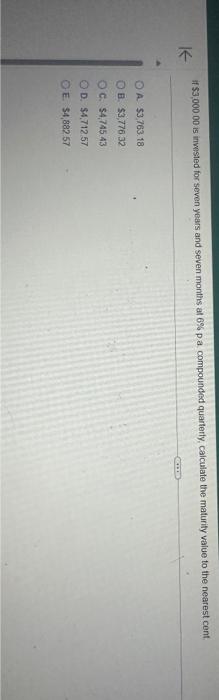

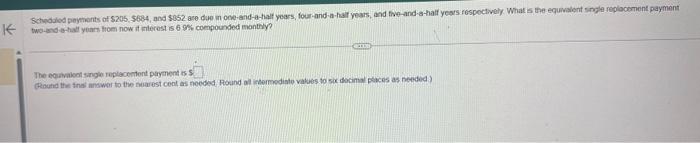

What sum of money will grow to $3404.48 in five years at 9.5% compounded annually? The sum of money is $ (Round to the nearest cent as needed. Round all intermediate values to six decimal places as needed.) acrumbiated value be 15 yews aher the change? Tiw acconviated vave is two-ano-e-tall yeass from now if intorest is 69% compounded monthy? The nquvenent snge replacensort poytront is ? (Feund the fins mewer to the noatest cent as nooded Round al imermediate volues to sa docmal places as neoded) two-and ahall years hom now if enterest is 6.9% compounded monthy? The equavacet single replacontont payenent is? An rwostment of $444825 earns interest at 66% per annum compounded quarterly for 4 years Al that time the interest rato is changed to 51% compounded semi-annualy, How much wil the accurmilated value be 15 years aftor the chenge? The accurnulated value is $ (Round the fina answer to the nearest cent as needed, Round at intermedate valaes to six decimal places as noeded) A dernand loan for $11,70681 with interest at 7.4% compounded quarterly is repaid after 2 years, 11 months. What is the amount of interest paid The amount of interest is $ (Round the final answer to the hearest cent as needed. Round all intormediate values to six decimal places as needed) What is the principal that will grow to $5900 in five years, one month at 2.1% compounded monthiy? The principal is : (Round to the nearest cent as needed Round at ichermediahe values to six decimal places as needed) A ban of $2500 is due in 6 years. If money is worth 4.3% compounded annually, find the equivalent payments that would settle the debt at the limes shown below (a) now (b) in 2 years (c) in 6 years (d) in 11 years (a) The equivalent loan payment is 5 (Round the firal answer to the moarest cent as needed. Round all intormodiate valuos to six docimal plachs as needed) (b) The equivalent kan payment is 5 (Round tho fral answer-to the neacest cent as neodod. Round all intermediate values to sox docimal places as needed) (c) The equivalent loan parment is 5 (Round the final answer to the nearest cent as needed Round all intermediate values to six decimal places as needed) (d) The equivakent loan payment is } (Round the finat answer to the nearest cent as needed. Round all intermediate values to six decimal placos as needed.) if $3,000.00 is invested for seven years and seven months at 6% a compounded quarterly, calculate the maturity value to the nearest cent A. $3763.18 B. 53,77632 c. $4,745,43 D. $4,71257 E. 34,88257