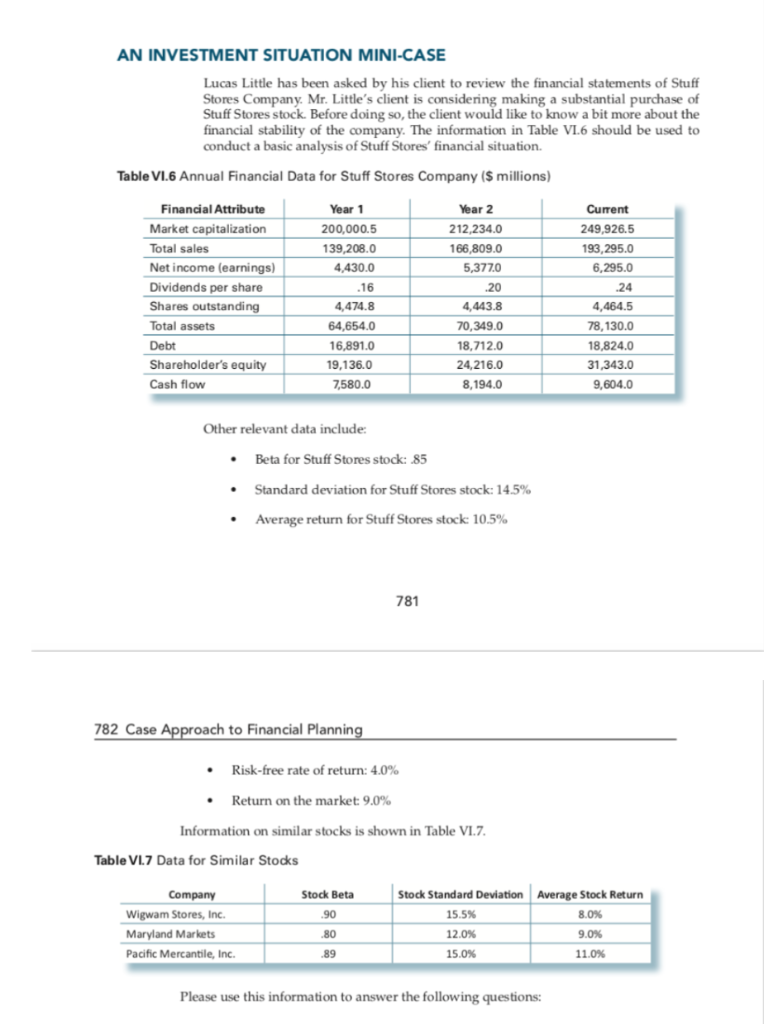

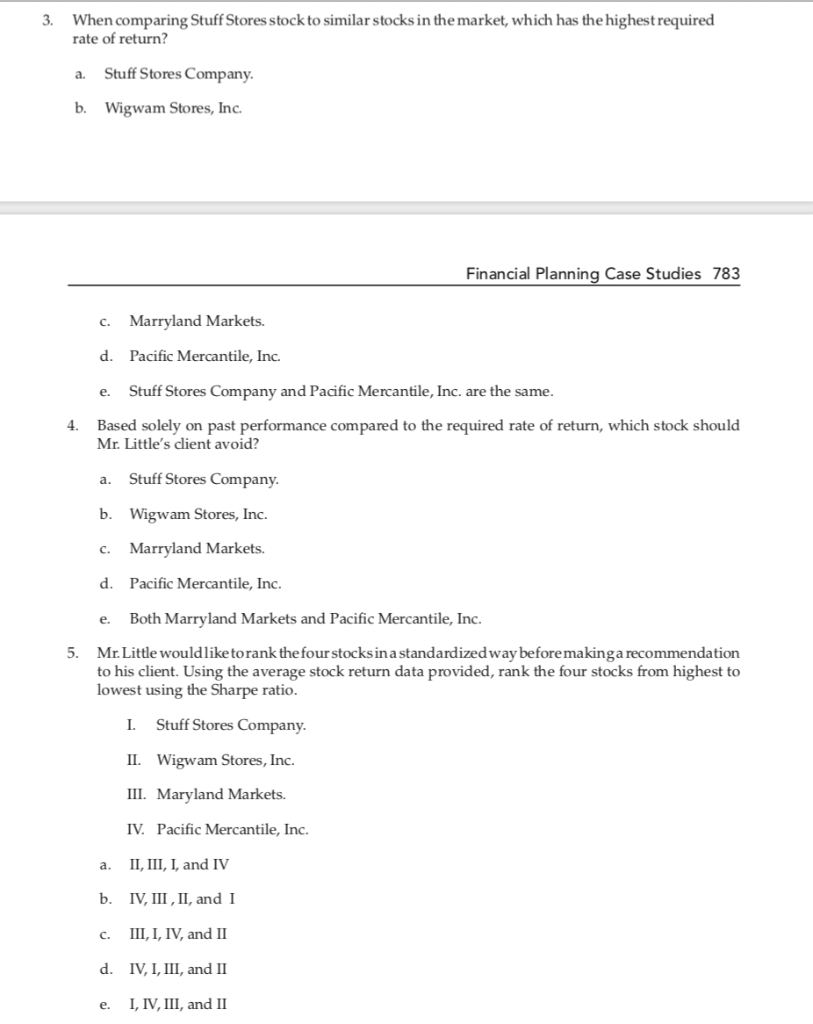

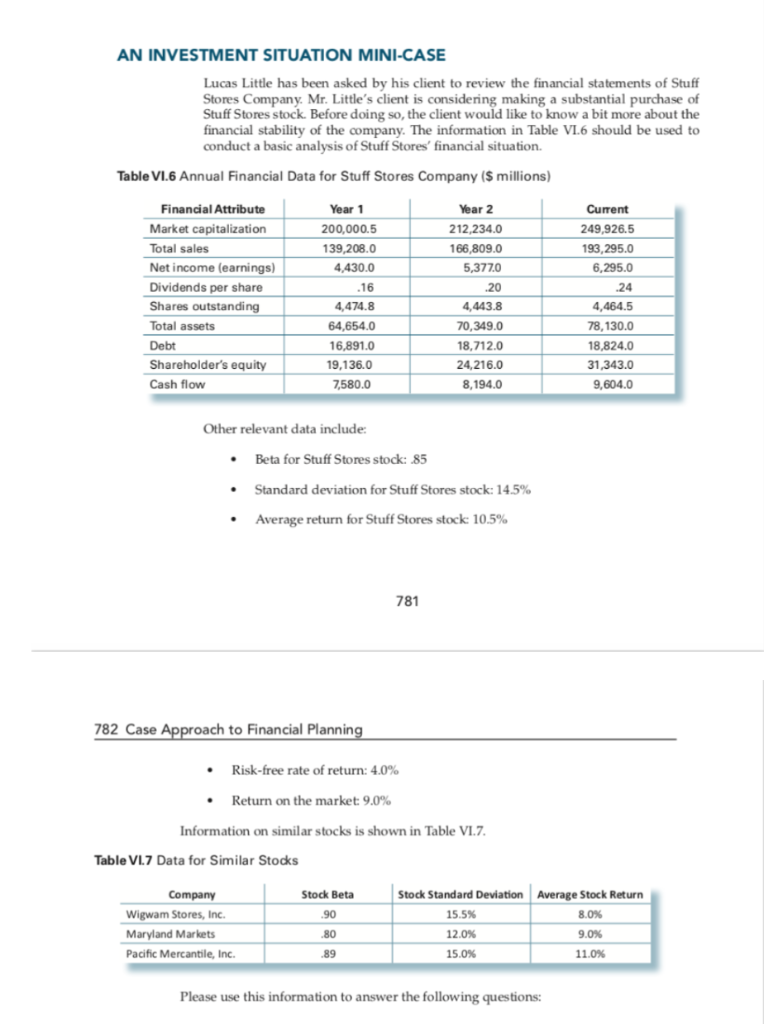

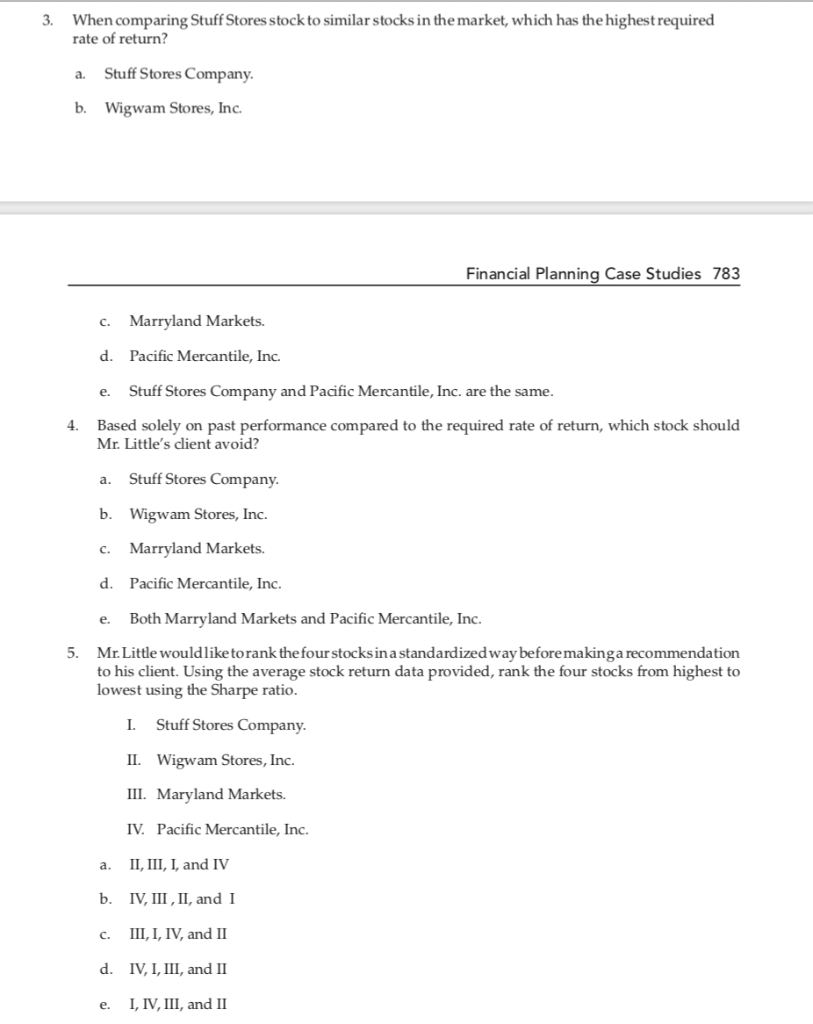

AN INVESTMENT SITUATION MINI-CASE Lucas Little has been asked by his client to review the financial statements of Stuff Stores Company. Mr. Little's client is considering making a substantial purchase of Stuff Stores stock. Before doing so, the client would like to know a bit more about the financial stability of the company. The information in Table VL6 should be used to conduct a basic analysis of Stuff Stores' financial situation Table VI.6 Annual Financial Data for Stuff Stores Company (S millions) Financial Attribute Market capitalization Total sales Net income (earnings) Dividends per share Shares outstanding Total assets Debt Shareholder's equity Cash flow Year 1 200,000.5 39,208.0 4,430.0 Year 2 Current 249,926.5 93,295.O 6,295.0 .24 4,464.5 78,130.0 8,824.0 31,343.0 9,604.0 212,234.O 66,809.0 5,3770 16 20 4,474.8 64,654.0 6,891.0 19,136.0 7,580.0 4,443.8 70,349.0 18,712.0 24,216.0 8,194.0 Other relevant data include . Beta for Stuff Stores stock: 85 Standard deviation for Stuff Stores stock: 14.5% Average return for Stuff Stores stock: 10.5% 781 782 Case oach to Financial Plannin Risk-free rate of return: 4.0% Return on the market: 9.0% Information on similar stocks is shown in Table VI.7 Table VI7 Data for Similar Stocks Stock Beta 90 .80 89 Stock Standard Deviation 15.5% 12.0% 15.0% Average Stock Return 80% 9.0% 11.0% Company Wigwam Stores, Inc. Maryland Markets Pacific Mercantile, Inc Please use this information to answer the following questions: 3. When comparing Stuff Stores stock to similar stocks in the market, which has the highest required rate of return? a. Stuff Stores Company b. Wigwam Stores, Inc Financial Planning Case Studies 783 C. Marryland Markets. d. Pacific Mercantile, Inc. Stuff Stores Company and Pacific Mercantile, Inc. are the same e. 4. Based solely on past performance compared to the required rate of return, which stock should Mr. Little's client avoid? a. Stuff Stores Company b. Wigwam Stores, Inc. c. Marryland Markets. d. Pacific Mercantile, Inc e. Both Marryland Markets and Pacific Mercantile, Inc. 5. Mr.Little wouldliketorank the four stocks in a standardizedway beforemakinga recommendation to his client. Using the average stock return data provided, rank the four stocks from highest to lowest using the Sharpe ratio I. Stuff Stores Company II. Wigwam Stores, Inc. II Maryland Markets. IV. Pacific Mercantile, Inc. a. II, III, I, and IV b. IV, III,II, and I c. III,I, IV, and II d. IV,I, III, and II e. I, IV,III, and