Answered step by step

Verified Expert Solution

Question

1 Approved Answer

An investor buys a bond with a $100 par value and a 5% coupon rate for $97. The bond pays interest semiannually. Exactly one

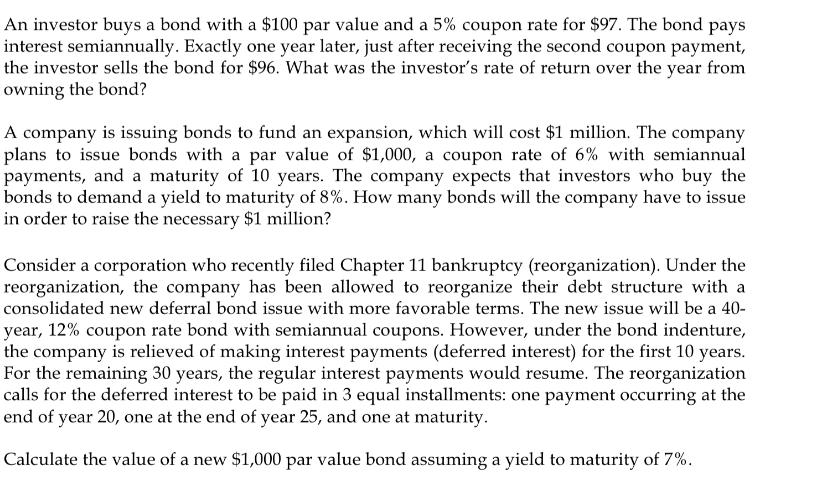

An investor buys a bond with a $100 par value and a 5% coupon rate for $97. The bond pays interest semiannually. Exactly one year later, just after receiving the second coupon payment, the investor sells the bond for $96. What was the investor's rate of return over the year from owning the bond? A company is issuing bonds to fund an expansion, which will cost $1 million. The company plans to issue bonds with a par value of $1,000, a coupon rate of 6% with semiannual payments, and a maturity of 10 years. The company expects that investors who buy the bonds to demand a yield to maturity of 8%. How many bonds will the company have to issue in order to raise the necessary $1 million? Consider a corporation who recently filed Chapter 11 bankruptcy (reorganization). Under the reorganization, the company has been allowed to reorganize their debt structure with a consolidated new deferral bond issue with more favorable terms. The new issue will be a 40- year, 12% coupon rate bond with semiannual coupons. However, under the bond indenture, the company is relieved of making interest payments (deferred interest) for the first 10 years. For the remaining 30 years, the regular interest payments would resume. The reorganization calls for the deferred interest to be paid in 3 equal installments: one payment occurring at the end of year 20, one at the end of year 25, and one at maturity. Calculate the value of a new $1,000 par value bond assuming a yield to maturity of 7%.

Step by Step Solution

★★★★★

3.38 Rating (164 Votes )

There are 3 Steps involved in it

Step: 1

The investors rate of return over the year from owning the bond is approximately 206 To calculate the rate of return you would need to determine the t...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started