Answered step by step

Verified Expert Solution

Question

1 Approved Answer

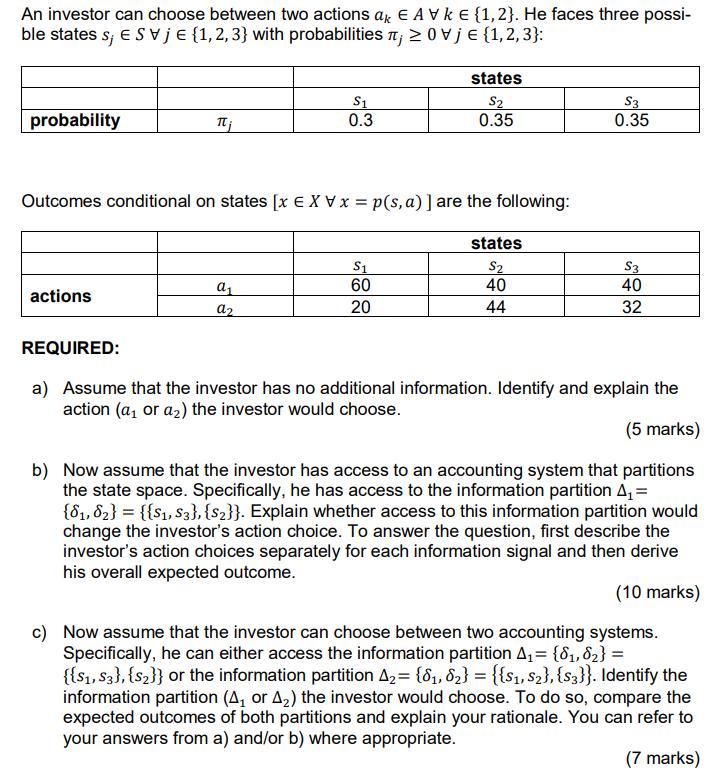

An investor can choose between two actions ak E AVKE {1,2}. He faces three possi- ble states s; ES Vje {1,2,3} with probabilities ;

An investor can choose between two actions ak E AVKE {1,2}. He faces three possi- ble states s; ES Vje {1,2,3} with probabilities ; Vje {1,2,3}: probability actions It j REQUIRED: Outcomes conditional on states [x EXV x = p(s, a) ] are the following: S1 0.3 a a states S2 0.35 S1 60 20 states $2 40 44 S3 0.35 S3 40 32 a) Assume that the investor has no additional information. Identify and explain the action (a or a) the investor would choose. (5 marks) b) Now assume that the investor has access to an accounting system that partitions the state space. Specifically, he has access to the information partition 4 = {81, 82} = {{$, $3}, {$}}. Explain whether access to this information partition would change the investor's action choice. To answer the question, first describe the investor's action choices separately for each information signal and then derive his overall expected outcome. (10 marks) c) Now assume that the investor can choose between two accounting systems. Specifically, he can either access the information partition A= {8, 8} = {{S, S3}, {$}} or the information partition A = {6, 6} = {{S, S2}, {S3}}. Identify the information partition (A or A) the investor would choose. To do so, compare the expected outcomes of both partitions and explain your rationale. You can refer to your answers from a) and/or b) where appropriate. (7 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a Without any additional information the investor would choose the action with the highest expected outcome To determine the expected outcome for each ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started