Answered step by step

Verified Expert Solution

Question

1 Approved Answer

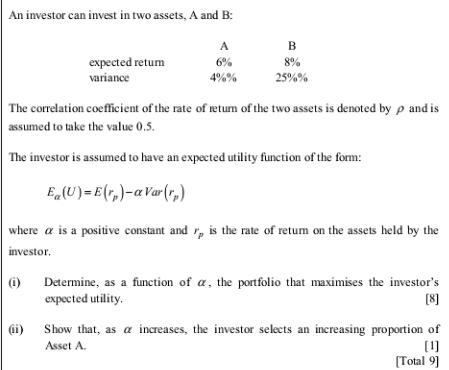

An investor can invest in two assets, A and B: expected retur variance (i) A 6% 4%% The correlation coefficient of the rate of

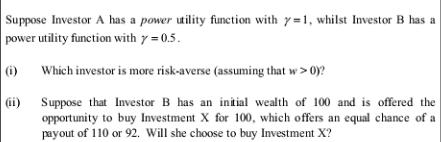

An investor can invest in two assets, A and B: expected retur variance (i) A 6% 4%% The correlation coefficient of the rate of return of the two assets is denoted by p and is assumed to take the value 0.5. The investor is assumed to have an expected utility function of the form: E(U)=E(r)-a Var () (ii) B 8% 25%% where a is a positive constant and r, is the rate of return on the assets held by the investor. Determine, as a function of a, the portfolio that maximises the investor's expected utility. [8] Show that, as a increases, the investor selects an increasing proportion of Asset A. [1] [Total 9] Suppose Investor A has a power utility function with y=1, whilst Investor B has a power utility function with y = 0.5. (i) Which investor is more risk-averse (assuming that w > 0)? (ii) Suppose that Investor B has an initial wealth of 100 and is offered the opportunity to buy Investment X for 100, which offers an equal chance of a payout of 110 or 92. Will she choose to buy Investment X?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started