Answered step by step

Verified Expert Solution

Question

1 Approved Answer

An investor estimates the expected return on domestic and international stocks to be the same, but the variances are different a standard deviation of

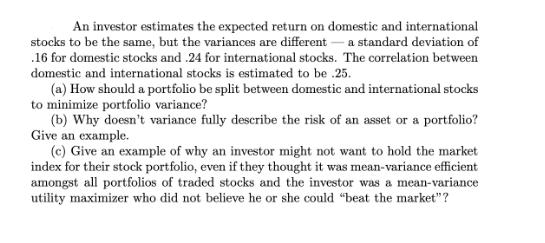

An investor estimates the expected return on domestic and international stocks to be the same, but the variances are different a standard deviation of .16 for domestic stocks and .24 for international stocks. The correlation between domestic and international stocks is estimated to be .25. (a) How should a portfolio be split between domestic and international stocks to minimize portfolio variance? (b) Why doesn't variance fully describe the risk of an asset or a portfolio? Give an example. (c) Give an example of why an investor might not want to hold the market index for their stock portfolio, even if they thought it was mean-variance efficient amongst all portfolios of traded stocks and the investor was a mean-variance utility maximizer who did not believe he or she could "beat the market"?

Step by Step Solution

★★★★★

3.38 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Solution a To minimize portfolio variance the portfolio should be split between domestic and international stocks in a ratio of 06 domestic to 04 inte...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started