Answered step by step

Verified Expert Solution

Question

1 Approved Answer

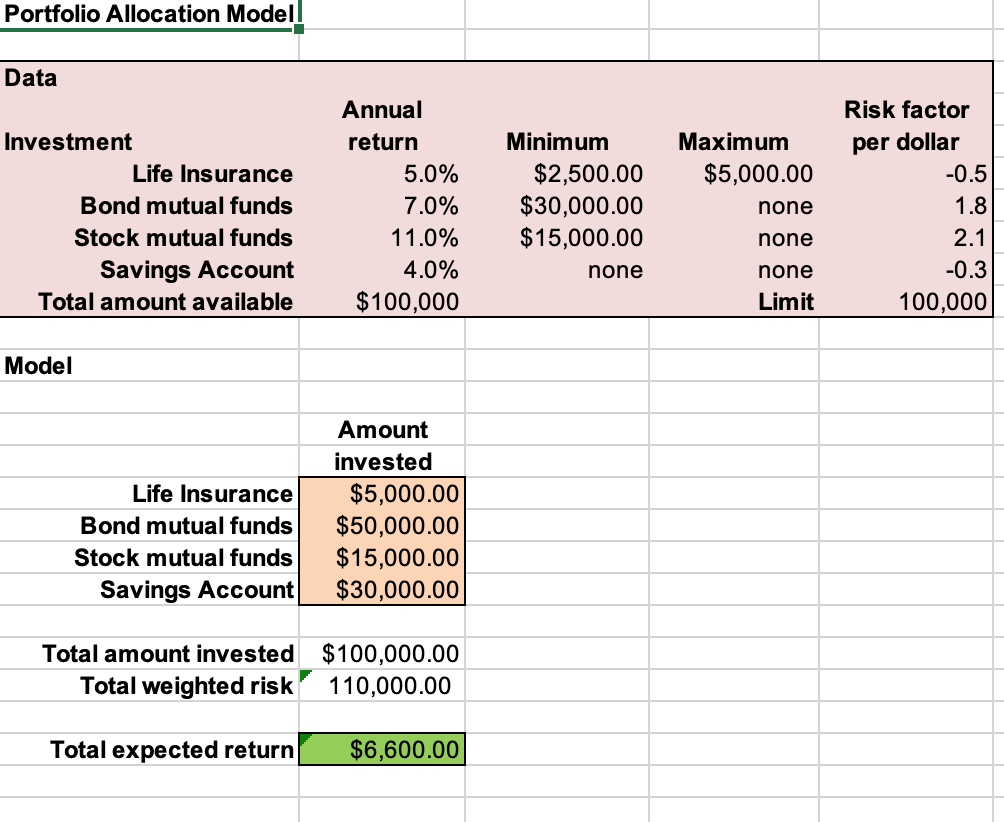

An investor has $100,000 to invest in four assets. The expected annual returns, minimum and maximum amounts with which the investor will be comfortable allocating

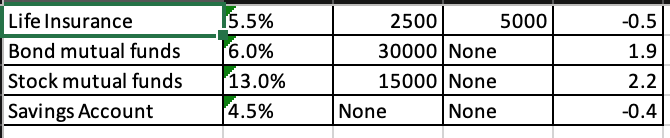

An investor has $100,000 to invest in four assets. The expected annual returns, minimum and maximum amounts with which the investor will be comfortable allocating to each investment, and risk factors are shown in the accompanying table. Assume that the investor will tolerate a weighted risk per dollar invested of at most 1.0. Experiment with the accompanying portfolio allocation model to attempt to find the best solution that maximizes the expected annual return and meets the total weighted risk constraint.

Portfolio Allocation Modell Data Investment Life Insurance Bond mutual funds Stock mutual funds Savings Account Total amount available Model Life Insurance Bond mutual funds Stock mutual funds Savings Account Annual return 5.0% 7.0% 11.0% 4.0% $100,000 Amount invested $5,000.00 $50,000.00 $15,000.00 $30,000.00 Total amount invested $100,000.00 Total weighted risk 110,000.00 Total expected return $6,600.00 Minimum $2,500.00 $30,000.00 $15,000.00 none Maximum $5,000.00 none none none Limit Risk factor per dollar -0.5 1.8 2.1 -0.3 100,000 Life Insurance Bond mutual funds Stock mutual funds Savings Account 15.5% 6.0% 13.0% 4.5% 2500 30000 None 15000 None None None 5000 -0.5 1.9 2.2 -0.4

Step by Step Solution

★★★★★

3.45 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

Open a blank Excel workbook and enter the data as foll...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started