Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The RRR Company has a target current ratio of 2.4. Presently, the current ratio is 3.3 based on current assets of $6,567,000. If RRR

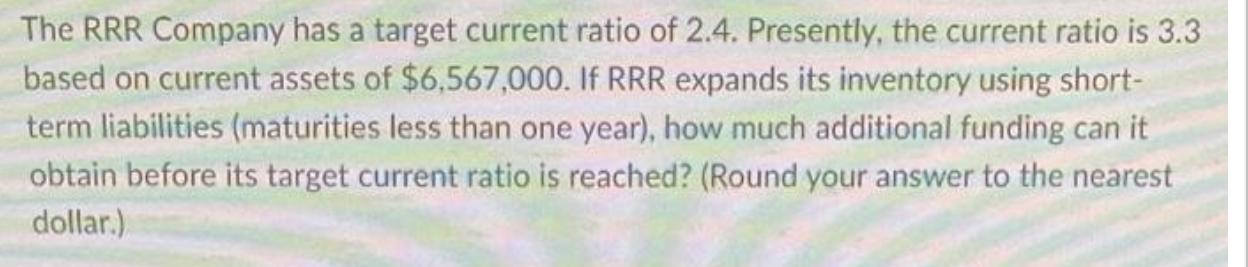

The RRR Company has a target current ratio of 2.4. Presently, the current ratio is 3.3 based on current assets of $6,567,000. If RRR expands its inventory using short- term liabilities (maturities less than one year), how much additional funding can it obtain before its target current ratio is reached? (Round your answer to the nearest dollar.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

lets break this down step by step to figure out how much additional funding RRR Company can obtain to hit their target current ratio without getting l...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started