Answered step by step

Verified Expert Solution

Question

1 Approved Answer

just finished the business plan of his start-up company. According to the projections he carried-out, the initial investment is 1,500,000 SAR (assume that we

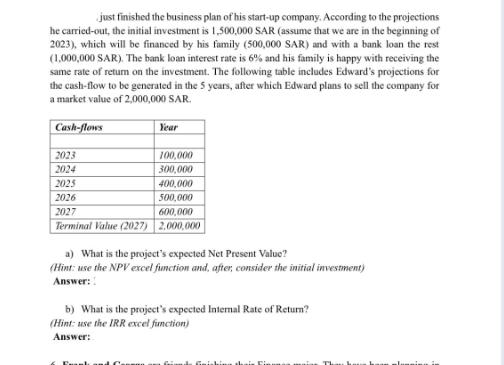

just finished the business plan of his start-up company. According to the projections he carried-out, the initial investment is 1,500,000 SAR (assume that we are in the beginning of 2023), which will be financed by his family (500,000 SAR) and with a bank loan the rest (1,000,000 SAR). The bank loan interest rate is 6% and his family is happy with receiving the same rate of return on the investment. The following table includes Edward's projections for the cash-flow to be generated in the 5 years, after which Edward plans to sell the company for a market value of 2,000,000 SAR. Cash-flows Year 2023 100,000 2024 300,000 2025 400,000 2026 500,000 2027 600,000 Terminal Value (2027) 2,000,000 a) What is the project's expected Net Present Value? (Hint: use the NPV excel function and, after, consider the initial investment) Answer: b) What is the project's expected Internal Rate of Return? (Hint: use the IRR excel function) Answer:

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a To calculate the Net Present Value NPV we need to discount each cash flow back to the present ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started