Question

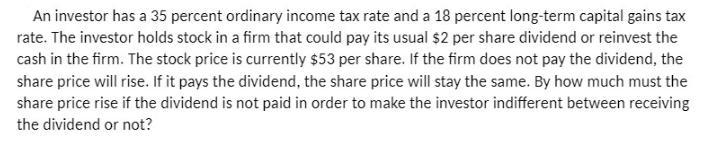

An investor has a 35 percent ordinary income tax rate and a 18 percent long-term capital gains tax rate. The investor holds stock in

An investor has a 35 percent ordinary income tax rate and a 18 percent long-term capital gains tax rate. The investor holds stock in a firm that could pay its usual $2 per share dividend or reinvest the cash in the firm. The stock price is currently $53 per share. If the firm does not pay the dividend, the share price will rise. If it pays the dividend, the share price will stay the same. By how much must the share price rise if the dividend is not paid in order to make the investor indifferent between receiving the dividend or not?

Step by Step Solution

3.42 Rating (171 Votes )

There are 3 Steps involved in it

Step: 1

To determine the amount by which the share price must rise if the dividend is not paid in order to m...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Principles Of Taxation For Business And Investment Planning 2016 Edition

Authors: Sally Jones, Shelley Rhoades Catanach

19th Edition

1259549259, 978-1259618536, 1259618536, 978-1259549250

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App