Question

An investor has just bought a semi-annual (181 days) bond with a face value of $5000, a coupon rate of 8%, maturing in 5

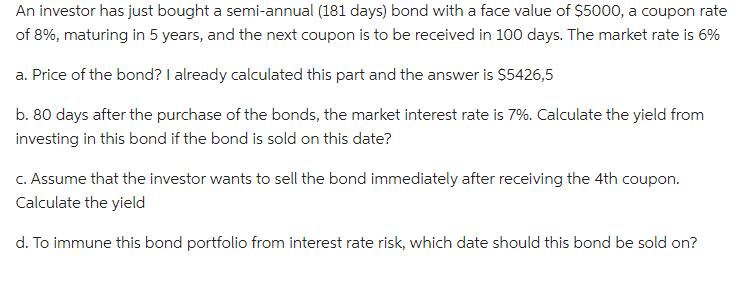

An investor has just bought a semi-annual (181 days) bond with a face value of $5000, a coupon rate of 8%, maturing in 5 years, and the next coupon is to be received in 100 days. The market rate is 6% a. Price of the bond? I already calculated this part and the answer is $5426,5 b. 80 days after the purchase of the bonds, the market interest rate is 7%. Calculate the yield from investing in this bond if the bond is sold on this date? c. Assume that the investor wants to sell the bond immediately after receiving the 4th coupon. Calculate the yield d. To immune this bond portfolio from interest rate risk, which date should this bond be sold on?

Step by Step Solution

3.43 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

The detailed ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

College Mathematics For Business Economics, Life Sciences, And Social Sciences

Authors: Raymond Barnett, Michael Ziegler, Karl Byleen, Christopher Stocker

14th Edition

0134674146, 978-0134674148

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App