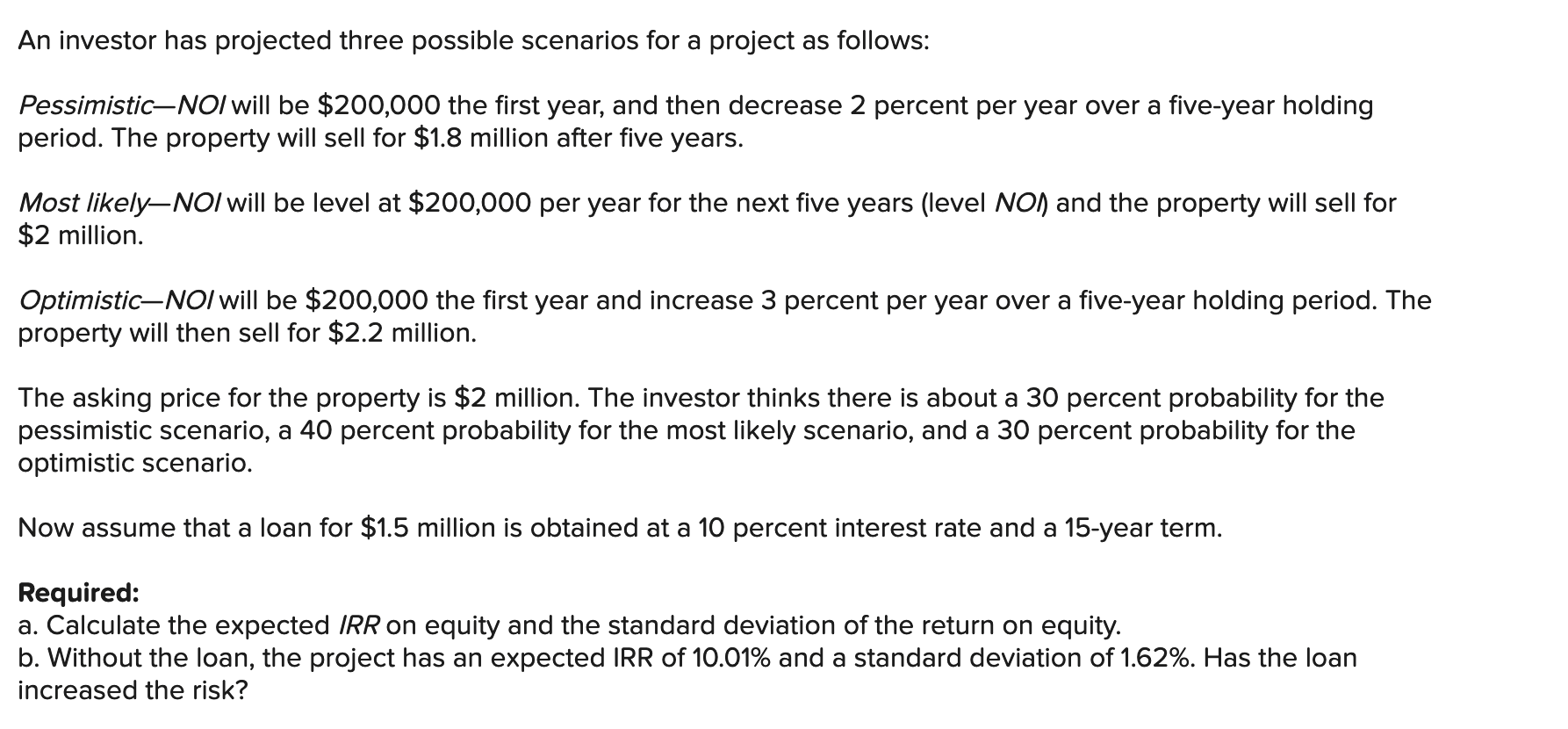

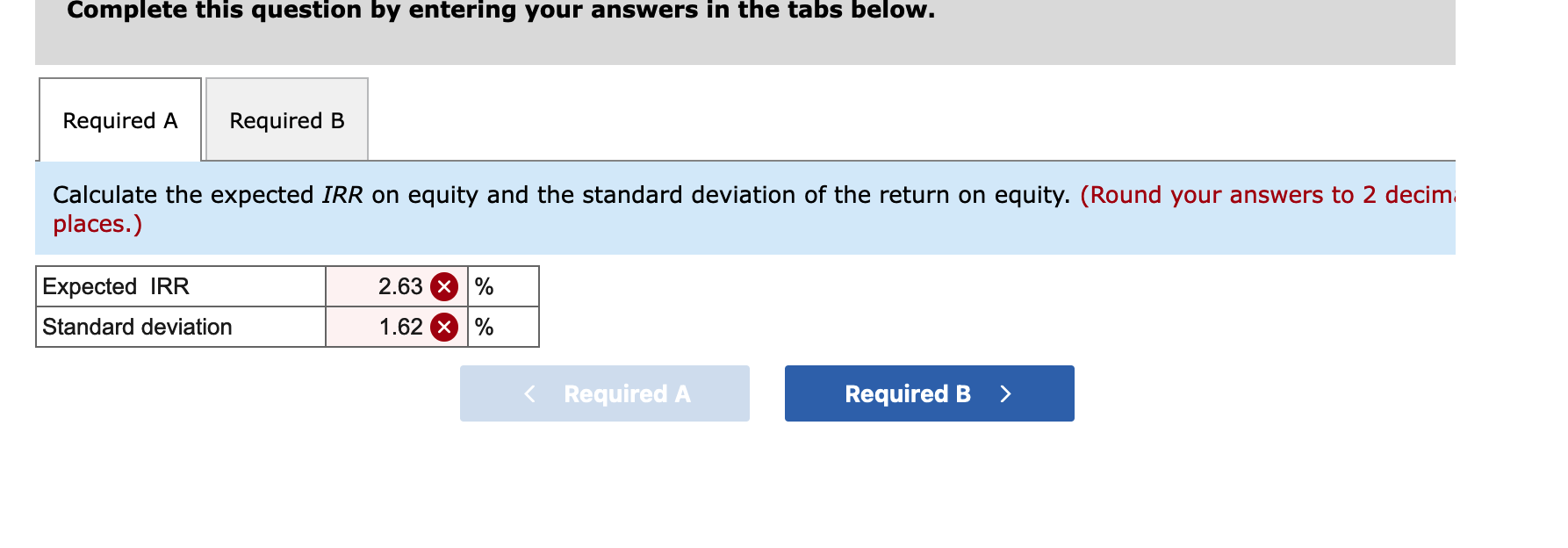

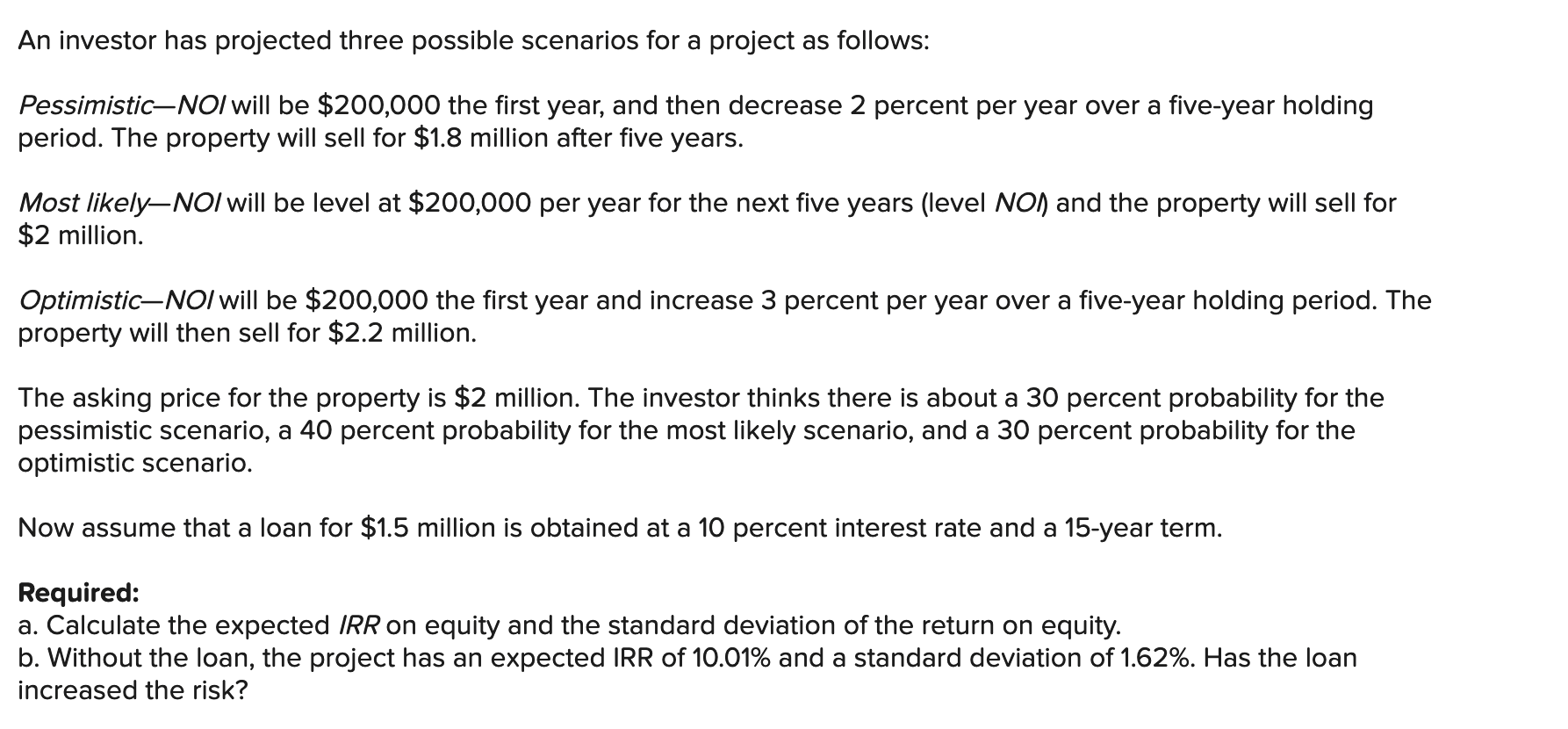

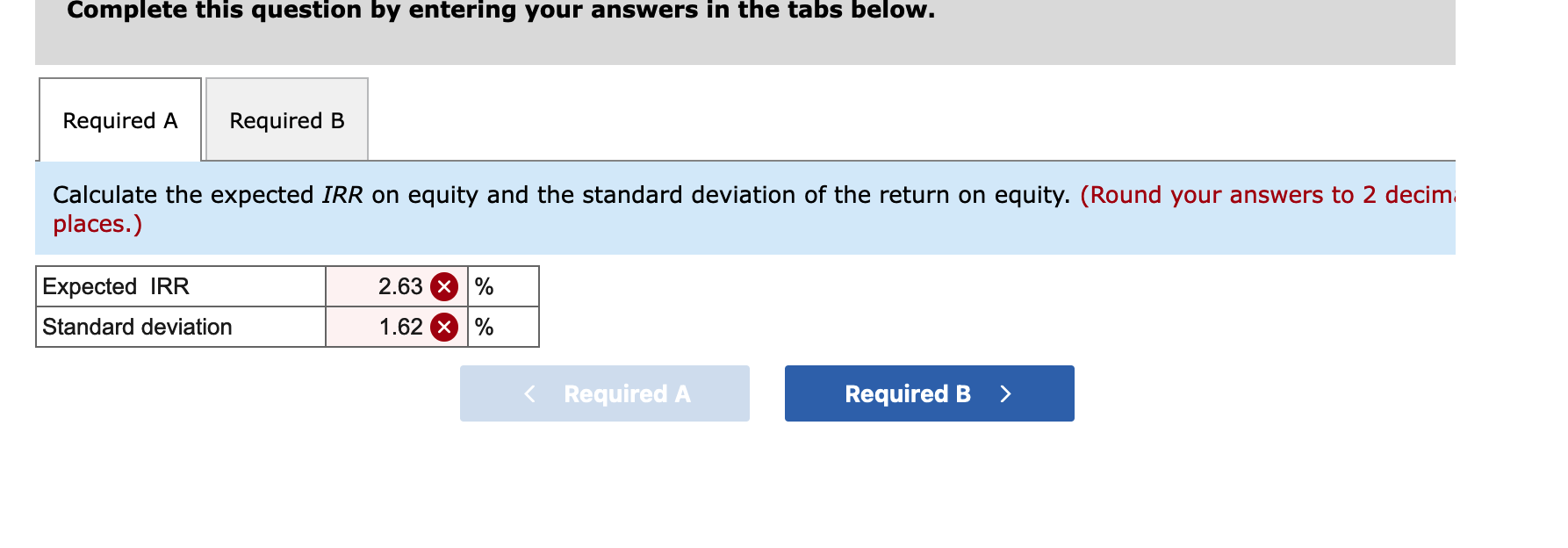

An investor has projected three possible scenarios for a project as follows: Pessimistic - NO/ will be $200,000 the first year, and then decrease 2 percent per year over a five-year holding period. The property will sell for $1.8 million after five years. Most likelyNOI will be level at $200,000 per year for the next five years (level NOI and the property will sell for $2 million. Optimistic - NOI will be $200,000 the first year and increase 3 percent per year over a five-year holding period. The property will then sell for $2.2 million. The asking price for the property is $2 million. The investor thinks there is about a 30 percent probability for the pessimistic scenario, a 40 percent probability for the most likely scenario, and a 30 percent probability for the optimistic scenario. Now assume that a loan for $1.5 million is obtained at a 10 percent interest rate and a 15-year term. Required: a. Calculate the expected IRR on equity and the standard deviation of the return on equity. b. Without the Ioan, the project has an expected IRR of 10.01% and a standard deviation of 1.62%. Has the loan increased the risk? Complete this question by entering your answers in the tabs below. Calculate the expected IRR on equity and the standard deviation of the return on equity. (Round your answers to 2 decin places.) An investor has projected three possible scenarios for a project as follows: Pessimistic - NO/ will be $200,000 the first year, and then decrease 2 percent per year over a five-year holding period. The property will sell for $1.8 million after five years. Most likelyNOI will be level at $200,000 per year for the next five years (level NOI and the property will sell for $2 million. Optimistic - NOI will be $200,000 the first year and increase 3 percent per year over a five-year holding period. The property will then sell for $2.2 million. The asking price for the property is $2 million. The investor thinks there is about a 30 percent probability for the pessimistic scenario, a 40 percent probability for the most likely scenario, and a 30 percent probability for the optimistic scenario. Now assume that a loan for $1.5 million is obtained at a 10 percent interest rate and a 15-year term. Required: a. Calculate the expected IRR on equity and the standard deviation of the return on equity. b. Without the Ioan, the project has an expected IRR of 10.01% and a standard deviation of 1.62%. Has the loan increased the risk? Complete this question by entering your answers in the tabs below. Calculate the expected IRR on equity and the standard deviation of the return on equity. (Round your answers to 2 decin places.)