Question

An investor is comparing three mutually exlcusive alternative projects A, B, and C. He plotted the following graph of the net present worth (NPV) of

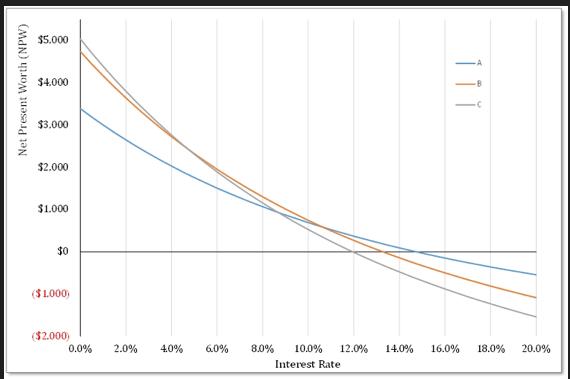

An investor is comparing three mutually exlcusive alternative projects A, B, and C. He plotted the following graph of the net present worth (NPV) of each alternative for interest rates ranging from 0% to 20%. Which project should the investor choose?

a) If the minimum accepted rate of return (MARR) is 2.0%.

b) If the minimum accepted rate of return (MARR) is 8.0%.

c) If the minimum accepted rate of return (MARR) is 13.0%.

d) If the minimum accepted rate of return (MARR) is 18.0%.

Net Present Worth (NPW) $5.000 $4.000 $3.000 $2.000 $1.000 $0 ($1.000) ($2.000) 0.0% 2.0% 4.0% 6.0% 8.0% 10.0% 12.0% Interest Rate 14.0% 16.0% 18.0% 20.0%

Step by Step Solution

3.44 Rating (141 Votes )

There are 3 Steps involved in it

Step: 1

The detailed answer for the above question is provided below To determine which project the investor ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Managing Business Ethics Making Ethical Decisions

Authors: Alfred A. Marcus, Timothy J. Hargrave

1st Edition

1506388590, 978-1506388595

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App