Answered step by step

Verified Expert Solution

Question

1 Approved Answer

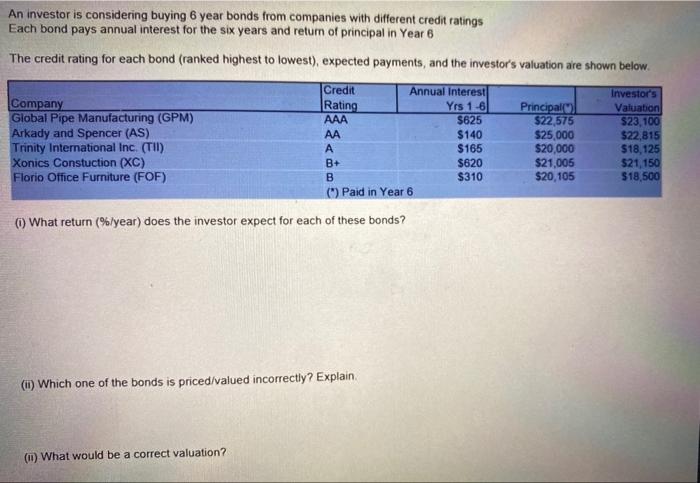

An investor is considering buying 6 year bonds from companies with different credit ratings Each bond pays annual interest for the six years and

An investor is considering buying 6 year bonds from companies with different credit ratings Each bond pays annual interest for the six years and return of principal in Year 6 The credit rating for each bond (ranked highest to lowest), expected payments, and the investor's valuation are shown below. Credit Annual Interest Yrs 1-6 $625 Investors Valuation Company Global Pipe Manufacturing (GPM) Arkady and Spencer (AS) Trinity International Inc. (TII) Xonics Constuction (XC) Florio Office Furniture (FOF) Rating AAA Principal $22,575 $25,000 $20,000 $21,005 $20, 105 $23,100 $22,815 $18,125 $21,150 $18,500 AA $140 A $165 $620 $310 B+ B (*) Paid in Year 6 ) What return (%/year) does the investor expect for each of these bonds? (i) Which one of the bonds is priced/valued incorrectly? Explain. (11) What would be a correct valuation?

Step by Step Solution

★★★★★

3.48 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

Answer to i Company Interest pa Year 16 Expected Principal Year 6 Expected Return Refer Note 1 PVIFA ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started