Answered step by step

Verified Expert Solution

Question

1 Approved Answer

An investor is considering buying an apartment complex for $2,000,000 that has a projected year one NOI of $140,000 and the NOI is expected to

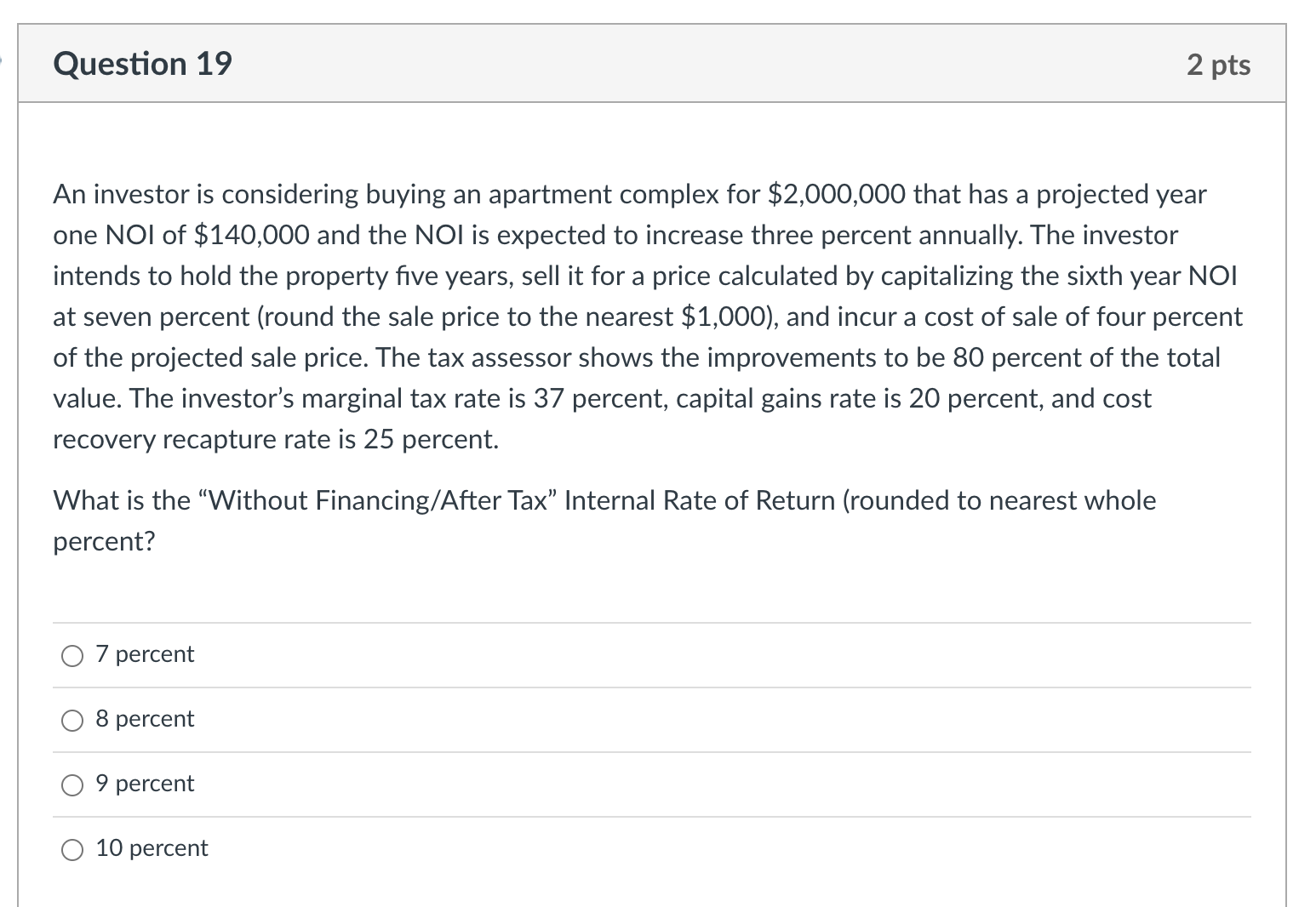

An investor is considering buying an apartment complex for $2,000,000 that has a projected year one NOI of $140,000 and the NOI is expected to increase three percent annually. The investor intends to hold the property five years, sell it for a price calculated by capitalizing the sixth year NOI at seven percent (round the sale price to the nearest $1,000 ), and incur a cost of sale of four percent of the projected sale price. The tax assessor shows the improvements to be 80 percent of the total value. The investor's marginal tax rate is 37 percent, capital gains rate is 20 percent, and cost recovery recapture rate is 25 percent. What is the "Without Financing/After Tax" Internal Rate of Return (rounded to nearest whole percent? 7 percent 8 percent 9 percent 10 percent

An investor is considering buying an apartment complex for $2,000,000 that has a projected year one NOI of $140,000 and the NOI is expected to increase three percent annually. The investor intends to hold the property five years, sell it for a price calculated by capitalizing the sixth year NOI at seven percent (round the sale price to the nearest $1,000 ), and incur a cost of sale of four percent of the projected sale price. The tax assessor shows the improvements to be 80 percent of the total value. The investor's marginal tax rate is 37 percent, capital gains rate is 20 percent, and cost recovery recapture rate is 25 percent. What is the "Without Financing/After Tax" Internal Rate of Return (rounded to nearest whole percent? 7 percent 8 percent 9 percent 10 percent Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started