Answered step by step

Verified Expert Solution

Question

1 Approved Answer

An investor is considering buying the River Creek Apt in Brighton. The apartment building can be purchased for $2,500,000. It has 6 apartments currently

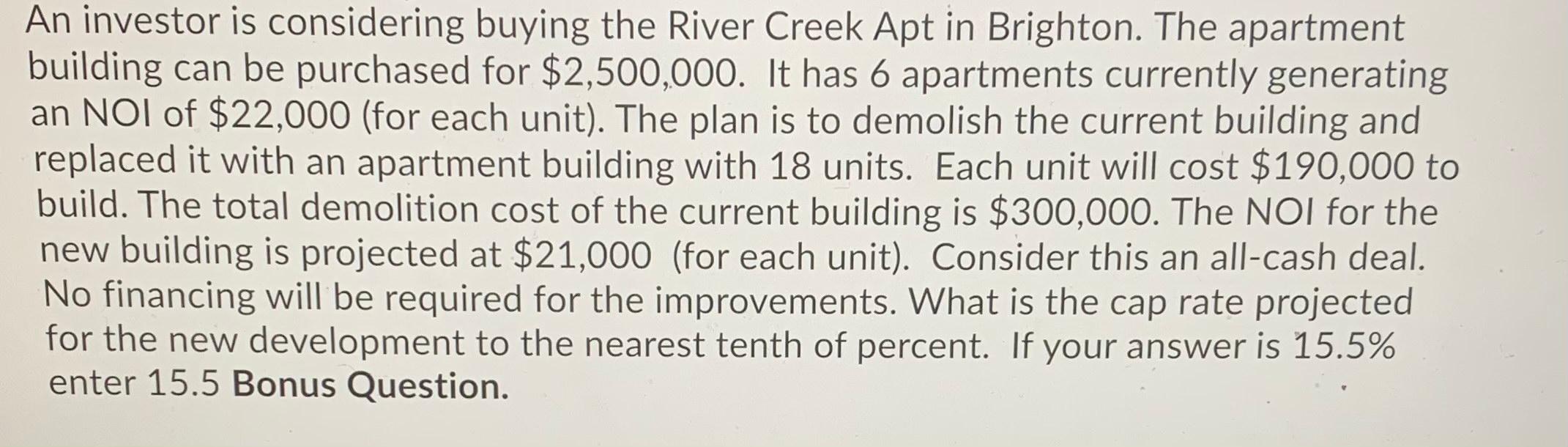

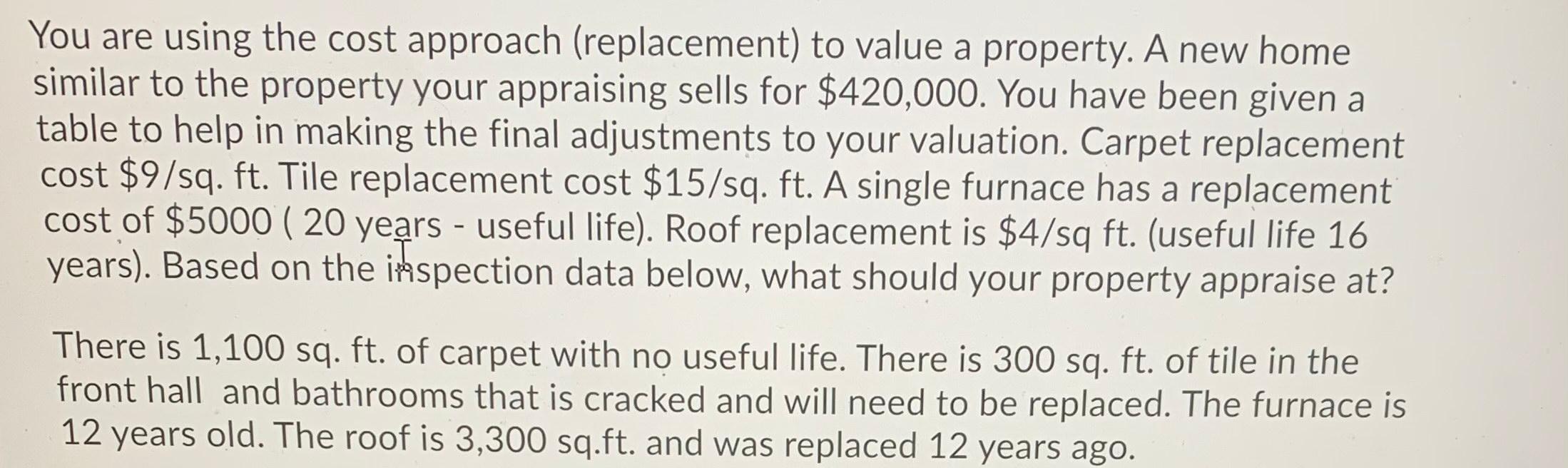

An investor is considering buying the River Creek Apt in Brighton. The apartment building can be purchased for $2,500,000. It has 6 apartments currently generating an NOI of $22,000 (for each unit). The plan is to demolish the current building and replaced it with an apartment building with 18 units. Each unit will cost $190,000 to build. The total demolition cost of the current building is $300,000. The NOI for the new building is projected at $21,000 (for each unit). Consider this an all-cash deal. No financing will be required for the improvements. What is the cap rate projected for the new development to the nearest tenth of percent. If your answer is 15.5% enter 15.5 Bonus Question. You are using the cost approach (replacement) to value a property. A new home similar to the property your appraising sells for $420,000. You have been given a table to help in making the final adjustments to your valuation. Carpet replacement cost $9/sq. ft. Tile replacement cost $15/sq. ft. A single furnace has a replacement cost of $5000 ( 20 years - useful life). Roof replacement is $4/sq ft. (useful life 16 years). Based on the inspection data below, what should your property appraise at? There is 1,100 sq. ft. of carpet with no useful life. There is 300 sq. ft. of tile in the front hall and bathrooms that is cracked and will need to be replaced. The furnace is 12 years old. The roof is 3,300 sq.ft. and was replaced 12 years ago.

Step by Step Solution

★★★★★

3.38 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

Total cost of Rier reennpt 2 purchase cour Add Demojtion codt ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started