Answered step by step

Verified Expert Solution

Question

1 Approved Answer

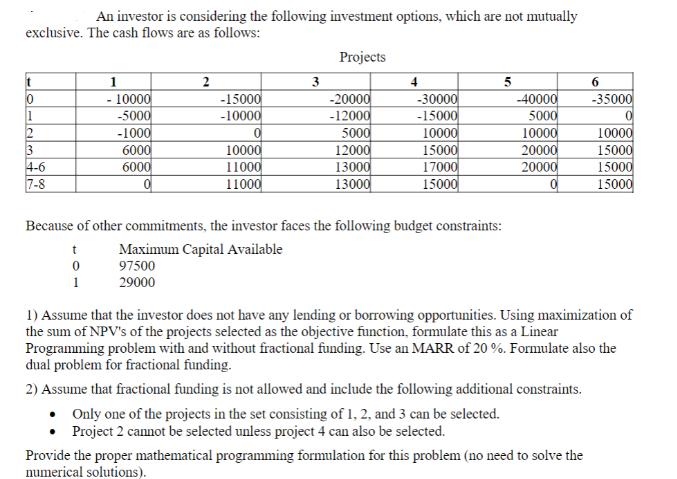

An investor is considering the following investment options, which are not mutually exclusive. The cash flows are as follows: t 10 11 2 3

An investor is considering the following investment options, which are not mutually exclusive. The cash flows are as follows: t 10 11 2 3 4-6 7-8 t 1 - 10000 -5000 0 1 -1000 6000 6000 2 -15000 -10000 0 10000 11000 11000 3 Projects -20000 -12000 5000 12000 13000 13000 4 -30000 -15000 10000 15000 17000 15000 Because of other commitments, the investor faces the following budget constraints: Maximum Capital Available 97500 29000 5 -40000 5000 10000 20000 20000 0 6 -35000 0 10000 15000 15000 15000 1) Assume that the investor does not have any lending or borrowing opportunities. Using maximization of the sum of NPV's of the projects selected as the objective function, formulate this as a Linear Programming problem with and without fractional funding. Use an MARR of 20 %. Formulate also the dual problem for fractional funding. 2) Assume that fractional funding is not allowed and include the following additional constraints. Only one of the projects in the set consisting of 1, 2, and 3 can be selected. Project 2 cannot be selected unless project 4 can also be selected. Provide the proper mathematical programming formulation for this problem (no need to solve the numerical solutions).

Step by Step Solution

★★★★★

3.41 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

1 Linear Programming Formulation Objective Function Maximi...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started