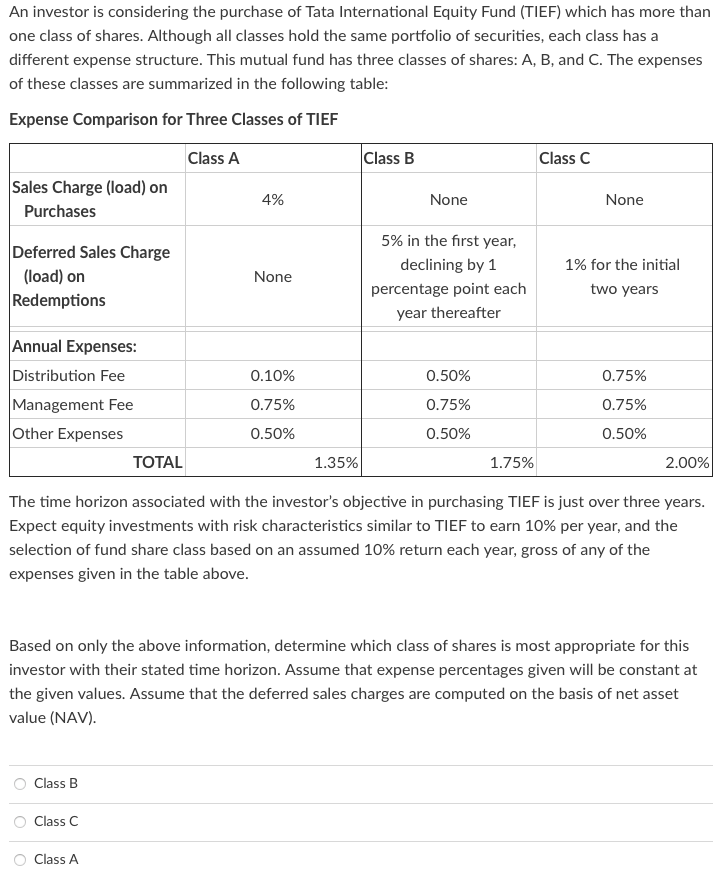

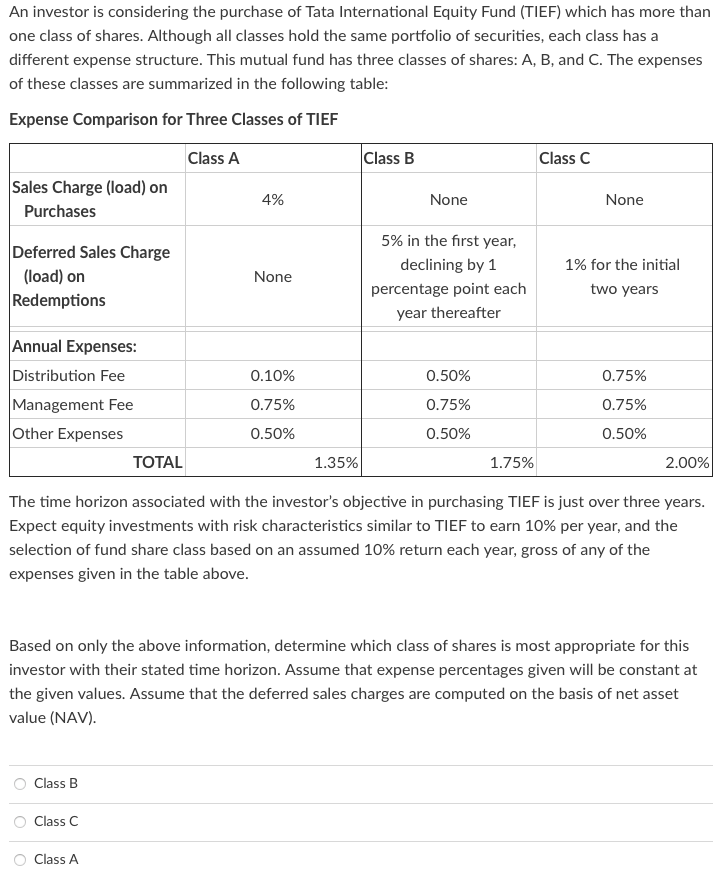

An investor is considering the purchase of Tata International Equity Fund (TIEF) which has more than one class of shares. Although all classes hold the same portfolio of securities, each class has a different expense structure. This mutual fund has three classes of shares: A, B, and C. The expenses of these classes are summarized in the following table: Expense Comparison for Three Classes of TIEF Class A Class B Class C Sales Charge (load) on Purchases 4% None None Deferred Sales Charge (load) on Redemptions None 5% in the first year, declining by 1 percentage point each year thereafter 1% for the initial two years 0.10% 0.50% 0.75% Annual Expenses: Distribution Fee Management Fee Other Expenses TOTAL 0.75% 0.75% 0.75% 0.50% 0.50% 0.50% 1.35% 1.75% 2.00% The time horizon associated with the investor's objective in purchasing TIEF is just over three years. Expect equity investments with risk characteristics similar to TIEF to earn 10% per year, and the selection of fund share class based on an assumed 10% return each year, gross of any of the expenses given in the table above. Based on only the above information, determine which class of shares is most appropriate for this investor with their stated time horizon. Assume that expense percentages given will be constant at the given values. Assume that the deferred sales charges are computed on the basis of net asset value (NAV). Class B Class C Class A An investor is considering the purchase of Tata International Equity Fund (TIEF) which has more than one class of shares. Although all classes hold the same portfolio of securities, each class has a different expense structure. This mutual fund has three classes of shares: A, B, and C. The expenses of these classes are summarized in the following table: Expense Comparison for Three Classes of TIEF Class A Class B Class C Sales Charge (load) on Purchases 4% None None Deferred Sales Charge (load) on Redemptions None 5% in the first year, declining by 1 percentage point each year thereafter 1% for the initial two years 0.10% 0.50% 0.75% Annual Expenses: Distribution Fee Management Fee Other Expenses TOTAL 0.75% 0.75% 0.75% 0.50% 0.50% 0.50% 1.35% 1.75% 2.00% The time horizon associated with the investor's objective in purchasing TIEF is just over three years. Expect equity investments with risk characteristics similar to TIEF to earn 10% per year, and the selection of fund share class based on an assumed 10% return each year, gross of any of the expenses given in the table above. Based on only the above information, determine which class of shares is most appropriate for this investor with their stated time horizon. Assume that expense percentages given will be constant at the given values. Assume that the deferred sales charges are computed on the basis of net asset value (NAV). Class B Class C Class A