Answered step by step

Verified Expert Solution

Question

1 Approved Answer

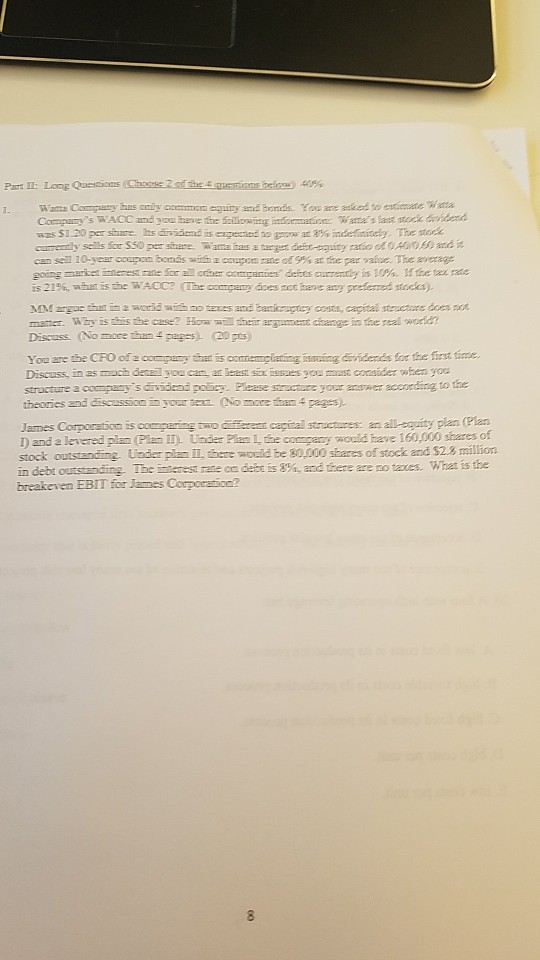

Part l: Long Queicm Wate Compuny hs oniy ccmmon equiry and bnas You are anked to etimate watta Compuny's WACC and you heve the fxillowing

Part l: Long Queicm Wate Compuny hs oniy ccmmon equiry and bnas You are anked to etimate watta Compuny's WACC and you heve the fxillowing intormationc warta's last neck dridena was $1.20 per shre hs drademd is expecied ow at 3s indetinitely. The tck curently sels for S50 per share ama has aarget deir-eqmity rato o 040i00 and can sell 10-year coupon bom?swah a coupon rate of9% at the par value. The aoerage gong marci i terest rae fr all cc ter compan s dents current y is 10%. If the tex rate ?S 21%, whit is the WACC? The company does not here asy preferred stocks. MM argar tins and angy cests, capital structure dees net matter. Wby is his becase? Hoalheir argament change in the real wccien Discass. No mareppes 2s You are the CFO of a compuny hat is comempiating issvis for the first tie Discuss, in as moch datail you can an least six issues you ust consider when you stracture a company's dvidend poicy. Flease structure your answer according to the theories and discussiyour st more han 4 pages James Corporation is corringdfrent capial strectures an all-equity plan (Plan I) and a levered plan Plan II. Under Plan L the company would have 160,000 stares of stock outstanding. Uader plan IL there wovia be 80,000 shares of stock and $2.3 million in debt outstending The inserest rate on debt is , and there are no taxes. What is the breakeven EBIT for James Corporation

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started