Answered step by step

Verified Expert Solution

Question

1 Approved Answer

An investor is given the following information. Security J K State 1 (s=1) 12 24 Payoff State 2 (s=2) 20 10 Market prices P=

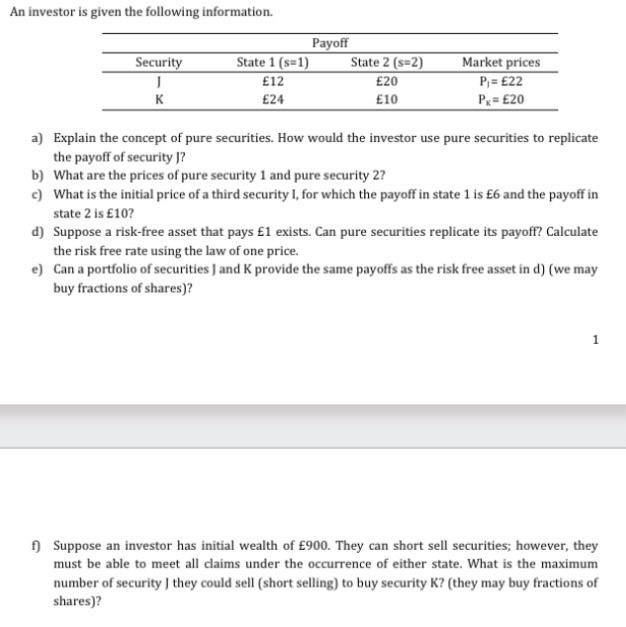

An investor is given the following information. Security J K State 1 (s=1) 12 24 Payoff State 2 (s=2) 20 10 Market prices P= 22 Px= 20 a) Explain the concept of pure securities. How would the investor use pure securities to replicate the payoff of security J? b) What are the prices of pure security 1 and pure security 2? c) What is the initial price of a third security I, for which the payoff in state 1 is 6 and the payoff in state 2 is 10? d) Suppose a risk-free asset that pays 1 exists. Can pure securities replicate its payoff? Calculate the risk free rate using the law of one price. e) Can a portfolio of securities J and K provide the same payoffs as the risk free asset in d) (we may buy fractions of shares)? f) Suppose an investor has initial wealth of 900. They can short sell securities; however, they must be able to meet all claims under the occurrence of either state. What is the maximum number of security I they could sell (short selling) to buy security K? (they may buy fractions of shares)?

Step by Step Solution

★★★★★

3.41 Rating (145 Votes )

There are 3 Steps involved in it

Step: 1

a Pure securities are financial instruments with known future payoffs in specific states of the world and they are used to replicate the payoffs of ot...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started