Answered step by step

Verified Expert Solution

Question

1 Approved Answer

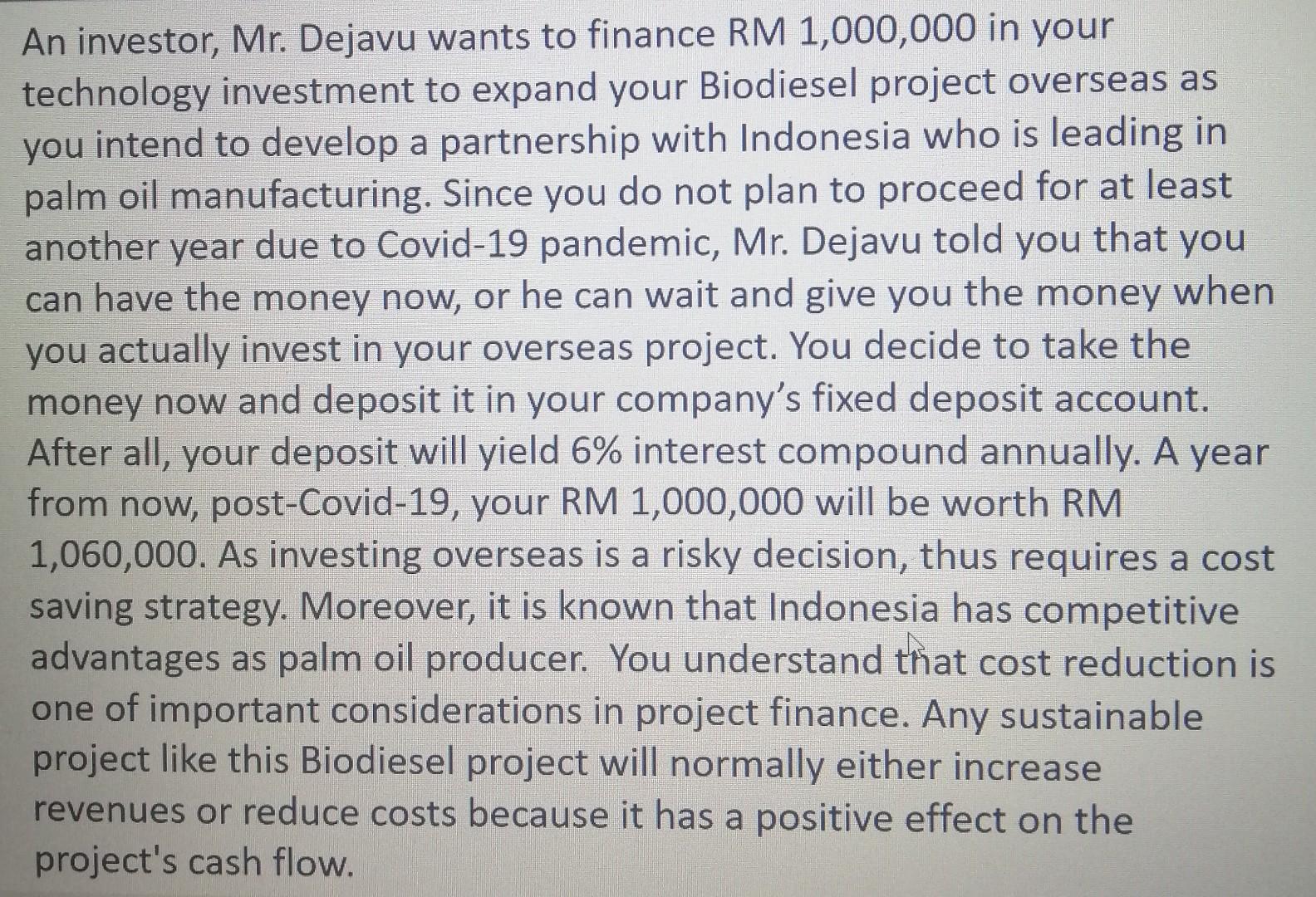

An investor, Mr. Dejavu wants to finance RM 1,000,000 in your technology investment to expand your Biodiesel project overseas as you intend to develop a

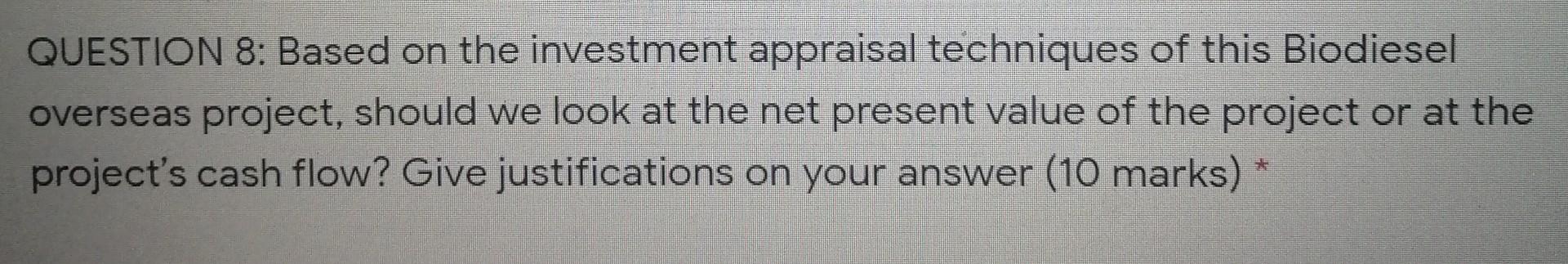

An investor, Mr. Dejavu wants to finance RM 1,000,000 in your technology investment to expand your Biodiesel project overseas as you intend to develop a partnership with Indonesia who is leading in palm oil manufacturing. Since you do not plan to proceed for at least another year due to Covid-19 pandemic, Mr. Dejavu told you that you can have the money now, or he can wait and give you the money when you actually invest in your overseas project. You decide to take the money now and deposit it in your company's fixed deposit account. After all, your deposit will yield 6% interest compound annually. A year from now, post-Covid-19, your RM 1,000,000 will be worth RM 1,060,000. As investing overseas is a risky decision, thus requires a cost saving strategy. Moreover, it is known that Indonesia has competitive advantages as palm oil producer. You understand that cost reduction is one of important considerations in project finance. Any sustainable project like this Biodiesel project will normally either increase revenues or reduce costs because it has a positive effect on the project's cash flow. QUESTION 8: Based on the investment appraisal techniques of this Biodiesel overseas project, should we look at the net present value of the project or at the project's cash flow? Give justifications on your answer (10 marks) *

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started