Answered step by step

Verified Expert Solution

Question

1 Approved Answer

An investor plans on investing in a 10-year project. The cashflows for the project are: An initial outlay of R100,000. Regular expenditure of R10,000 per

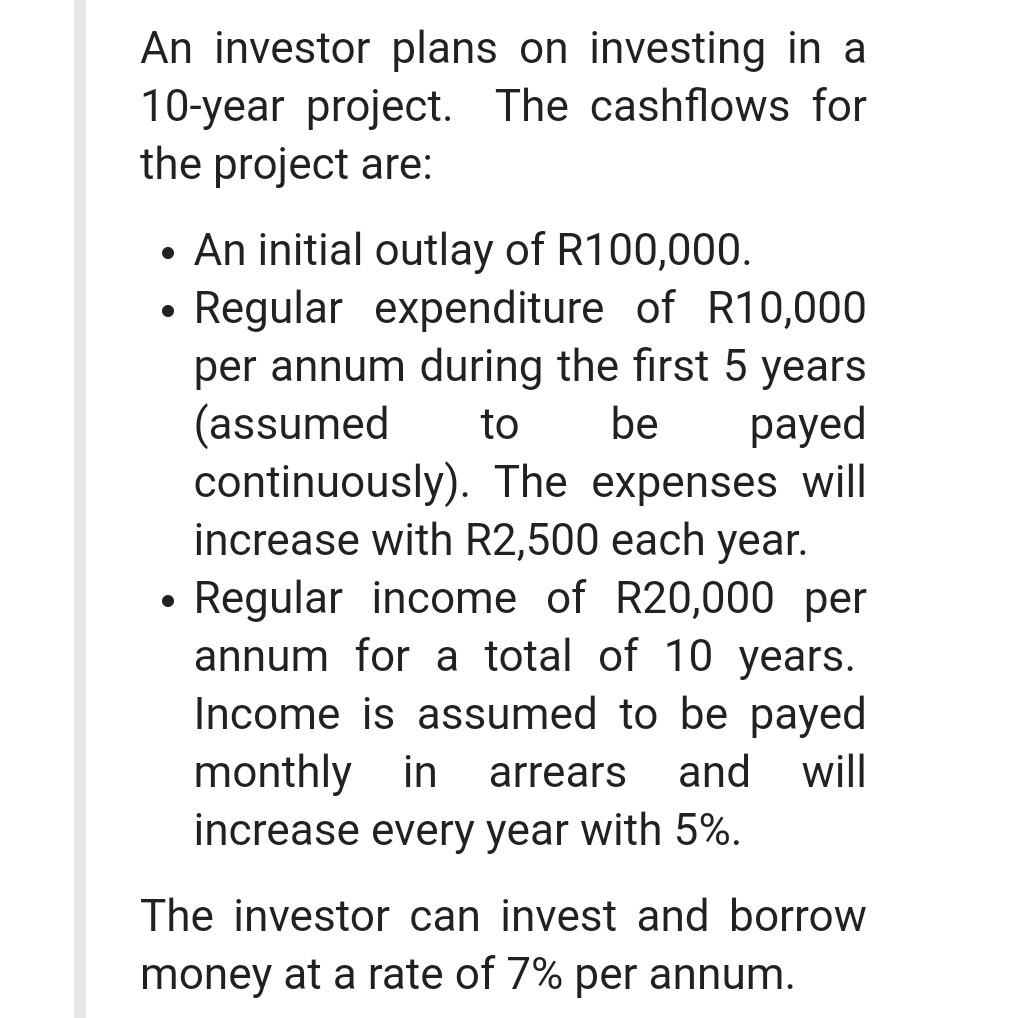

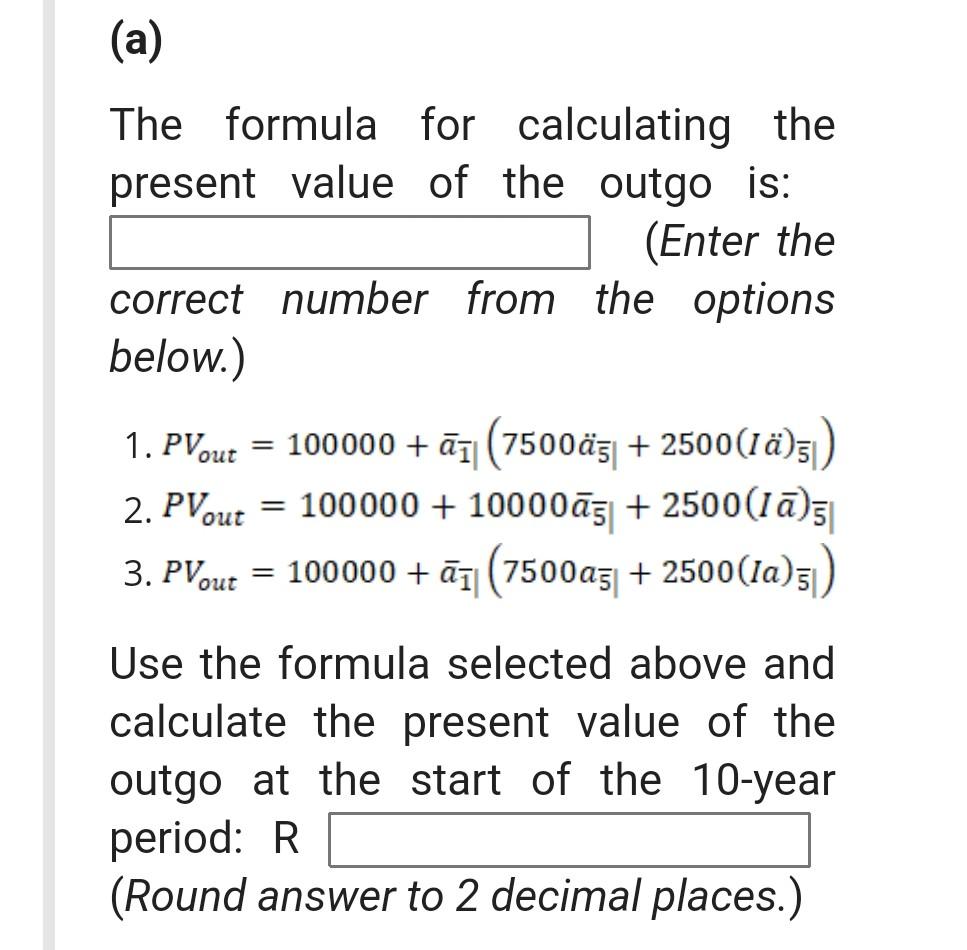

An investor plans on investing in a 10-year project. The cashflows for the project are: An initial outlay of R100,000. Regular expenditure of R10,000 per annum during the first 5 years (assumed to be payed continuously). The expenses will increase with R2,500 each year. Regular income of R20,000 per annum for a total of 10 years. Income is assumed to be payed monthly in arrears and will increase every year with 5%. The investor can invest and borrow money at a rate of 7% per annum. (a) The formula for calculating the present value of the outgo is: (Enter the correct number from the options below.) 1. PVout = 100000 + 711 (7500331 + 2500(1)31) 2. PVout = 100000 + 10000g + 2500(1); 3. PVout = 100000 + (7500231 + 2500(la)31) Use the formula selected above and calculate the present value of the outgo at the start of the 10-year period: R (Round answer to 2 decimal places.) (b) The formula for calculating the present value of the income is: (Enter the correct number from the options below.) 1. PV in (20000 x 12), 2. PV in = 20000 a7 12)a42) 451,0520,20 (12) (1-1.051010 1-1.05v 1-1.0510,10 in 1-1.05v = 20000 a (12) (1-1.0510,10 1-1.05v 3. PV in Use the formula selected above and calculate the present value of the income at the start of the 10-year period: R. (Round answer to 2 decimal places.) (c) The internal rate of return on this project will be: (Enter the correct number from the options given below.) 1. > 7% 2. = 7% 3.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started