Answered step by step

Verified Expert Solution

Question

1 Approved Answer

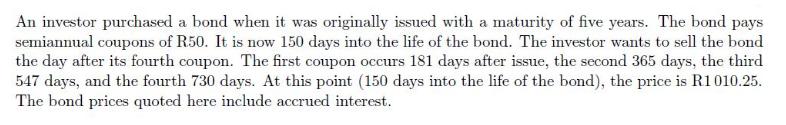

An investor purchased a bond when it was originally issued with a maturity of five years. The bond pays semiannual coupons of R50. It

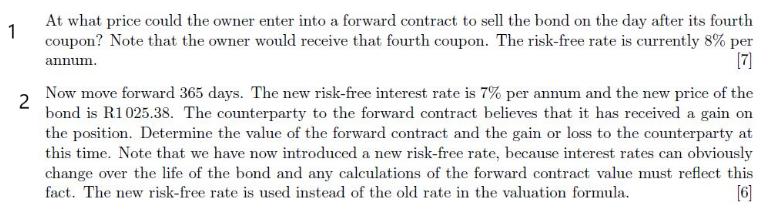

An investor purchased a bond when it was originally issued with a maturity of five years. The bond pays semiannual coupons of R50. It is now 150 days into the life of the bond. The investor wants to sell the bond the day after its fourth coupon. The first coupon occurs 181 days after issue, the second 365 days, the third 547 days, and the fourth 730 days. At this point (150 days into the life of the bond), the price is R1010.25. The bond prices quoted here include accrued interest. 1 At what price could the owner enter into a forward contract to sell the bond on the day after its fourth coupon? Note that the owner would receive that fourth coupon. The risk-free rate is currently 8% per [7] annum. Now move forward 365 days. The new risk-free interest rate is 7% per anmum and the new price of the bond is R1025.38. The counterparty to the forward contract believes that it has received a gain on the position. Determine the value of the forward contract and the gain or loss to the counterparty at this time. Note that we have now introduced a new risk-free rate, because interest rates can obviously change over the life of the bond and any calculations of the forward contract value must reflect this [6] fact. The new risk-free rate is used instead of the old rate in the valuation formula.

Step by Step Solution

★★★★★

3.43 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

Solution 1 Amount in Rs Coupon Inflow PVF 4 PV 50 0961 4805 50 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started