Answered step by step

Verified Expert Solution

Question

1 Approved Answer

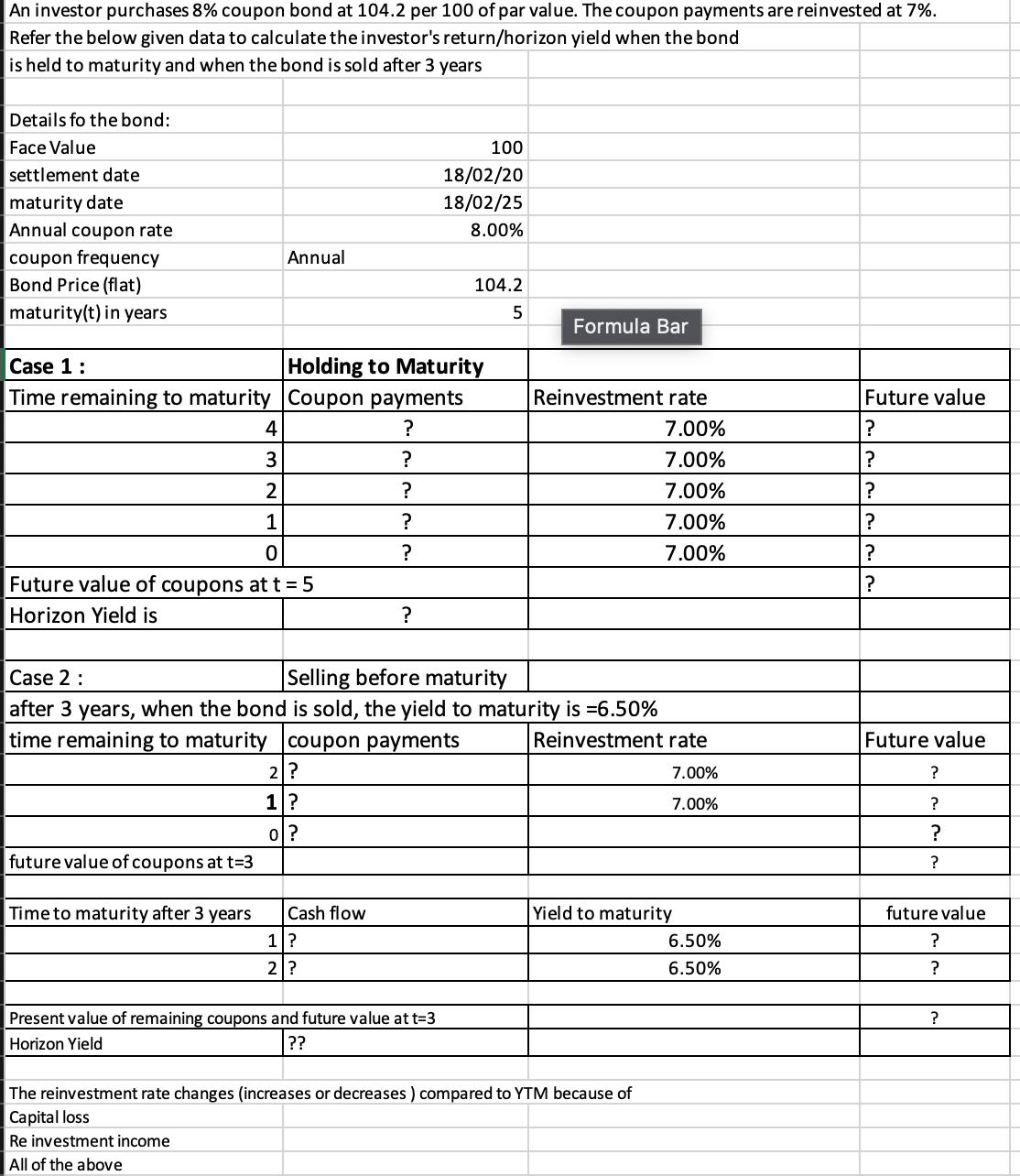

An investor purchases 8% coupon bond at 104.2 per 100 of par value. The coupon payments are reinvested at 7%. Refer the below given

An investor purchases 8% coupon bond at 104.2 per 100 of par value. The coupon payments are reinvested at 7%. Refer the below given data to calculate the investor's return/horizon yield when the bond is held to maturity and when the bond is sold after 3 years Details fo the bond: Face Value settlement date maturity date Annual coupon rate coupon frequency Bond Price (flat) maturity(t) in years Annual 4 3 2 1 0 Future value of coupons at t = 5 Horizon Yield is Case 1: Holding to Maturity Time remaining to maturity Coupon payments ? future value of coupons at t=3 Time to maturity after 3 years 2 ? 1? o? Cash flow ? 1? 2? ? ? ? ? 100 18/02/20 18/02/25 8.00% Case 2: Selling before maturity after 3 years, when the bond is sold, the yield to maturity is =6.50% time remaining to maturity coupon payments Reinvestment rate 7.00% 7.00% 104.2 5 Present value of remaining coupons and future value at t=3 Horizon Yield ?? Formula Bar Reinvestment rate 7.00% 7.00% 7.00% 7.00% 7.00% Yield to maturity The reinvestment rate changes (increases or decreases ) compared to YTM because of Capital loss Re investment income All of the above 6.50% 6.50% Future value ? ? ? ? ? ? Future value ? ? ? ? future value ? ? ?

Step by Step Solution

★★★★★

3.34 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

Case 1 Holding to Maturity To calculate the future value of coupon payments at each time period we use the formula for compound interest Future Value ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started