Question

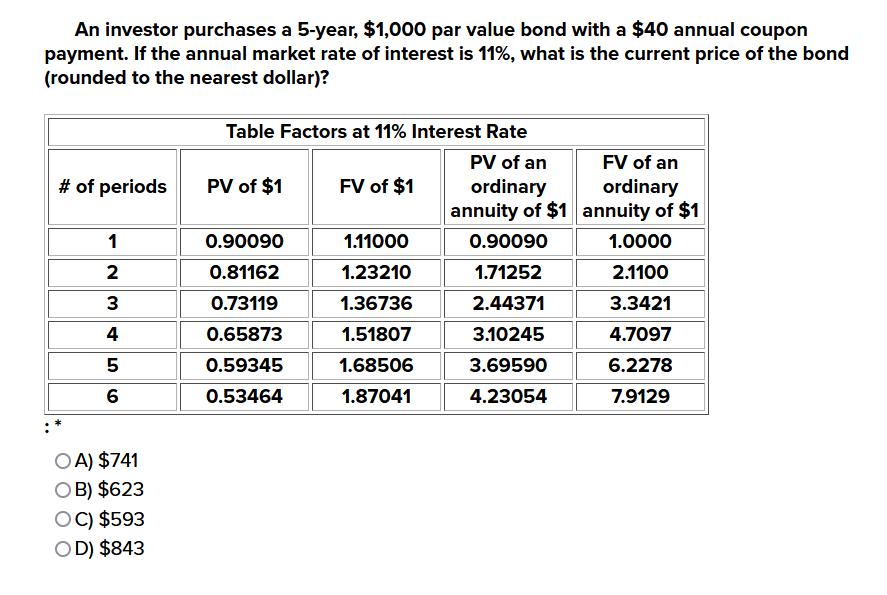

An investor purchases a 5-year, $1,000 par value bond with a $40 annual coupon payment. If the annual market rate of interest is 11%,

An investor purchases a 5-year, $1,000 par value bond with a $40 annual coupon payment. If the annual market rate of interest is 11%, what is the current price of the bond (rounded to the nearest dollar)? # of periods 1 N3456 2 OA) $741 OB) $623 OC) $593 OD) $843 Table Factors at 11% Interest Rate PV of an ordinary annuity of $1 PV of $1 0.90090 0.81162 0.73119 0.65873 0.59345 0.53464 FV of $1 1.11000 1.23210 1.36736 1.51807 1.68506 1.87041 0.90090 1.71252 2.44371 3.10245 3.69590 4.23054 FV of an ordinary annuity of $1 1.0000 2.1100 3.3421 4.7097 6.2278 7.9129

Step by Step Solution

3.47 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

The detailed answer for the above question is provided below Option A 741 Explanation The annual cou...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Intermediate Accounting

Authors: J. David Spiceland, James Sepe, Mark Nelson

6th edition

978-0077328894, 71313974, 9780077395810, 77328892, 9780071313971, 77395816, 978-0077400163

Students also viewed these General Management questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App