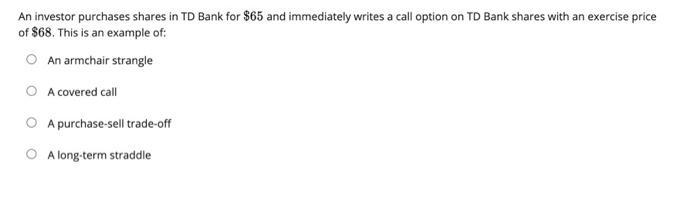

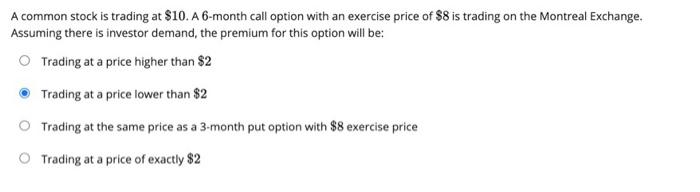

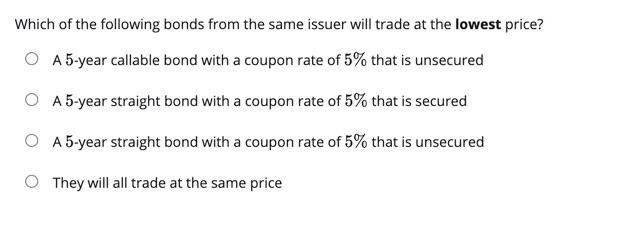

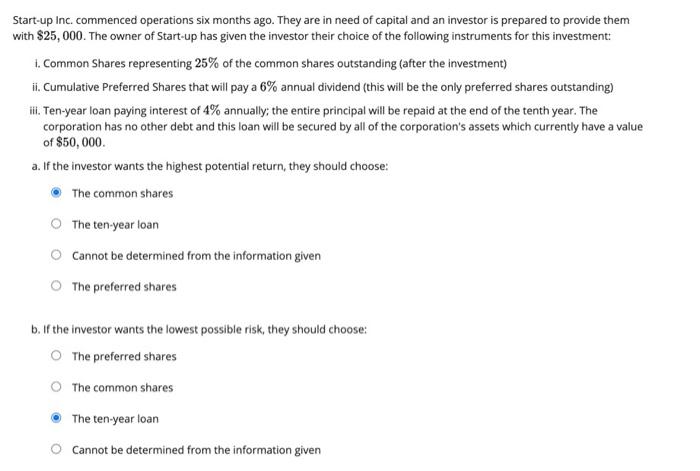

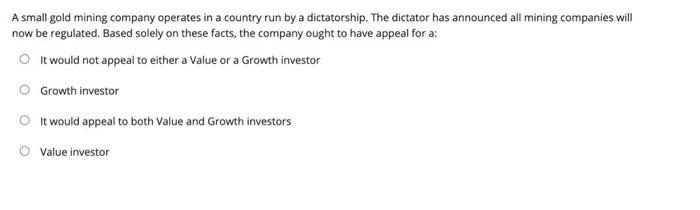

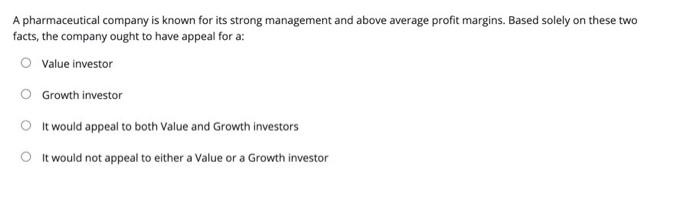

An investor purchases shares in TD Bank for $65 and immediately writes a call option on TD Bank shares with an exercise price of $68. This is an example of: An armchair strangle O A covered call A purchase-sell trade-off A long-term straddle A common stock is trading at $10.A 6-month call option with an exercise price of $8 is trading on the Montreal Exchange. Assuming there is investor demand, the premium for this option will be: Trading at a price higher than $2 Trading at a price lower than $2 Trading at the same price as a 3-month put option with $8 exercise price Trading at a price of exactly $2 Which of the following bonds from the same issuer will trade at the lowest price? O A 5-year callable bond with a coupon rate of 5% that is unsecured O A 5-year straight bond with a coupon rate of 5% that is secured O A 5-year straight bond with a coupon rate of 5% that is unsecured They will all trade at the same price Start-up Inc. commenced operations six months ago. They are in need of capital and an investor is prepared to provide them with $25,000. The owner of Start-up has given the investor their choice of the following instruments for this investment: 1. Common Shares representing 25% of the common shares outstanding (after the investment) ii. Cumulative Preferred Shares that will pay a 6% annual dividend (this will be the only preferred shares outstanding) iii. Ten-year loan paying interest of 4% annually; the entire principal will be repaid at the end of the tenth year. The corporation has no other debt and this loan will be secured by all of the corporation's assets which currently have a value of $50,000 a. If the investor wants the highest potential return, they should choose: The common shares The ten-year loan Cannot be determined from the information given The preferred shares b. If the investor wants the lowest possible risk, they should choose: The preferred shares The common shares The ten-year loan Cannot be determined from the information given A small gold mining company operates in a country run by a dictatorship. The dictator has announced all mining companies will now be regulated. Based solely on these facts, the company ought to have appeal for a: O it would not appeal to either a Value or a Growth investor Growth investor It would appeal to both Value and Growth investors o Value investor A pharmaceutical company is known for its strong management and above average profit margins. Based solely on these two facts, the company ought to have appeal for a: Value investor O Growth investor It would appeal to both Value and Growth investors It would not appeal to either a Value or a Growth investor