Answered step by step

Verified Expert Solution

Question

1 Approved Answer

An investor want to better understand how options are priced. She realizes that Options and Stock and a Bond (or Loan) have to match up

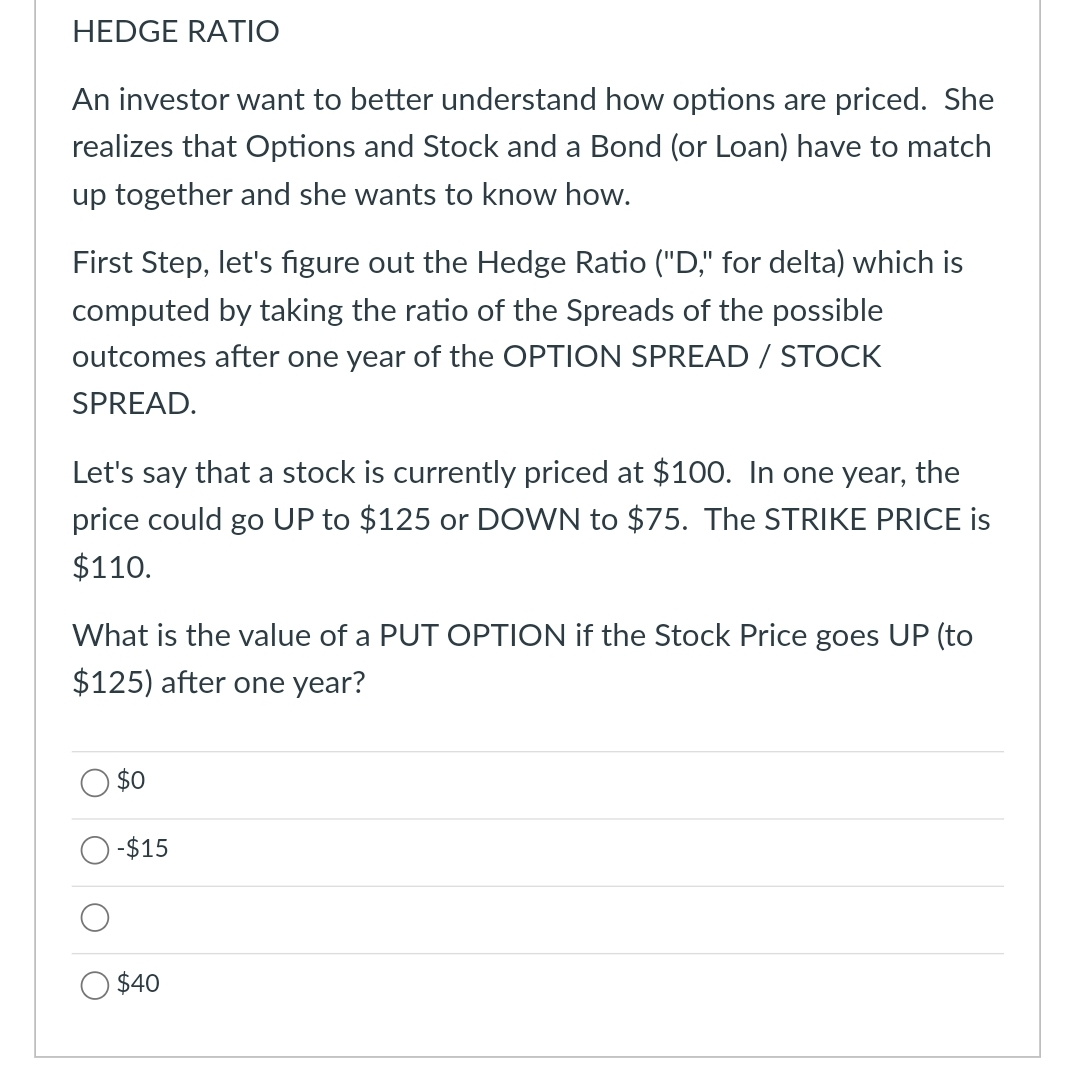

An investor want to better understand how options are priced. She realizes that Options and Stock and a Bond (or Loan) have to match up together and she wants to know how. First Step, let's figure out the Hedge Ratio ("D," for delta) which is computed by taking the ratio of the Spreads of the possible outcomes after one year of the OPTION SPREAD / STOCK SPREAD. Let's say that a stock is currently priced at $100. In one year, the price could go UP to $125 or DOWN to $75. The STRIKE PRICE is $110. What is the value of a PUT OPTION if the Stock Price goes UP (to \$125) after one year? $0 $15 $40

An investor want to better understand how options are priced. She realizes that Options and Stock and a Bond (or Loan) have to match up together and she wants to know how. First Step, let's figure out the Hedge Ratio ("D," for delta) which is computed by taking the ratio of the Spreads of the possible outcomes after one year of the OPTION SPREAD / STOCK SPREAD. Let's say that a stock is currently priced at $100. In one year, the price could go UP to $125 or DOWN to $75. The STRIKE PRICE is $110. What is the value of a PUT OPTION if the Stock Price goes UP (to \$125) after one year? $0 $15 $40 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started