Question

An investor wants to purchase a portfolio consisting of long a call with exercise price E = 190, and short a call with exercise

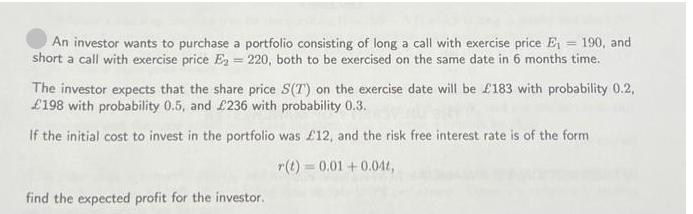

An investor wants to purchase a portfolio consisting of long a call with exercise price E = 190, and short a call with exercise price E = 220, both to be exercised on the same date in 6 months time. The investor expects that the share price S(T) on the exercise date will be 183 with probability 0.2, 198 with probability 0.5, and 236 with probability 0.3. If the initial cost to invest in the portfolio was 12, and the risk free interest rate is of the form r(t) = 0.01 +0.04t, find the expected profit for the investor.

Step by Step Solution

3.38 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Investment Analysis and Portfolio Management

Authors: Frank K. Reilly, Keith C. Brown

10th Edition

538482109, 1133711774, 538482389, 9780538482103, 9781133711773, 978-0538482387

Students also viewed these Corporate Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App