Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Consider a one step binomial tree for the portfolio II = AS-NB which is long A shares and short N bonds and the interest

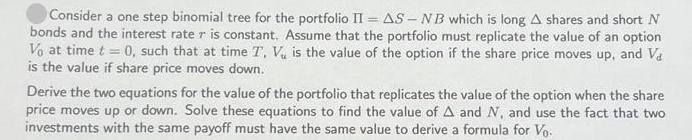

Consider a one step binomial tree for the portfolio II = AS-NB which is long A shares and short N bonds and the interest rate r is constant. Assume that the portfolio must replicate the value of an option Vo at time t= 0, such that at time T. V is the value of the option if the share price moves up, and V is the value if share price moves down. Derive the two equations for the value of the portfolio that replicates the value of the option when the share price moves up or down. Solve these equations to find the value of A and N, and use the fact that two investments with the same payoff must have the same value to derive a formula for Vo

Step by Step Solution

★★★★★

3.28 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

First well derive the equations for the value of the portfolio that replicates the value of the option when the share price moves up and down When the ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started