Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Based on the (a) (b) (e) data, calculate the following items: Net working capital for the year 2021. Net income for the year 2022.

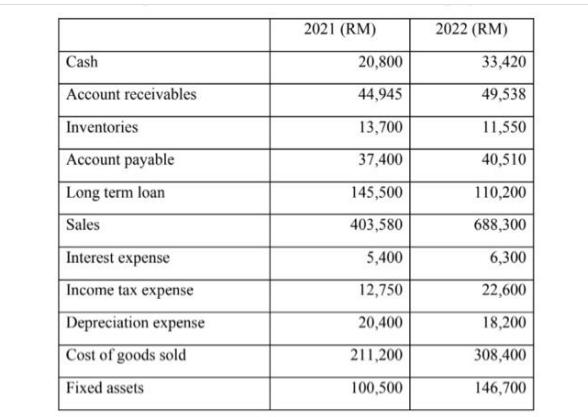

Based on the (a) (b) (e) data, calculate the following items: Net working capital for the year 2021. Net income for the year 2022. Operating cash flow for the year 2022. Cash flow from assets for the year 2022. Average tax rate for the year 2021, if tax liability is RM85,512. Cash Account receivables Inventories Account payable Long term loan Sales Interest expense Income tax expense Depreciation expense Cost of goods sold Fixed assets 2021 (RM) 20,800 44,945 13,700 37,400 145,500 403,580 5,400 12,750 20,400 211,200 100,500 2022 (RM) 33,420 49,538 11,550 40,510 110,200 688,300 6,300 22,600 18,200 308,400 146,700

Step by Step Solution

★★★★★

3.45 Rating (164 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the requested items use the given data and formulas for each item a Net Working Capital for the year 2021 Net Working Capital Current Ass...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started