Answered step by step

Verified Expert Solution

Question

1 Approved Answer

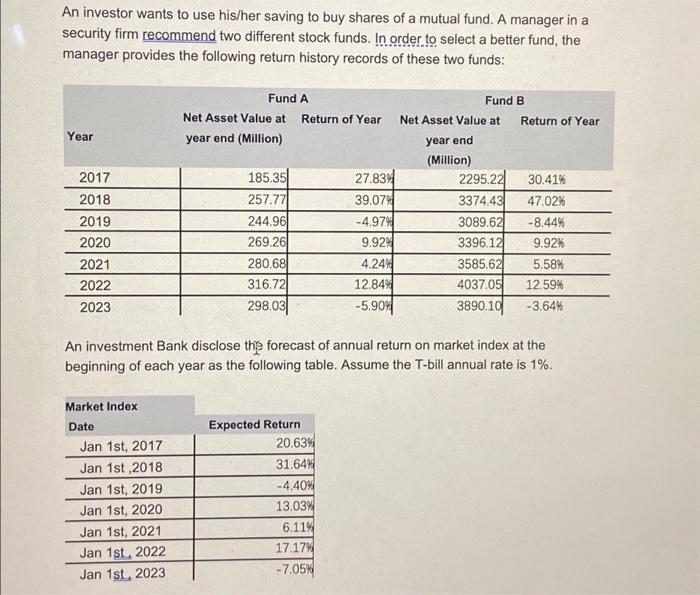

An investor wants to use his/her saving to buy shares of a mutual fund. A manager in a security firm recommend two different stock funds.

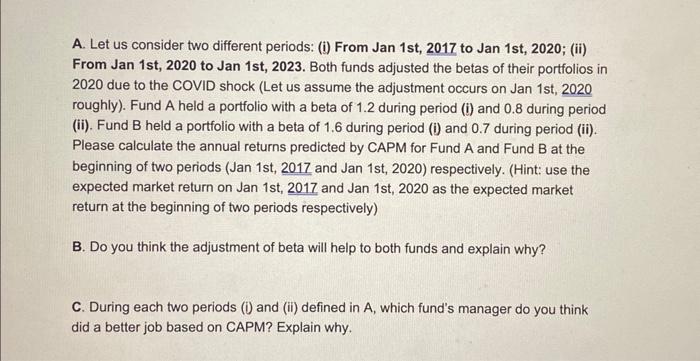

An investor wants to use his/her saving to buy shares of a mutual fund. A manager in a security firm recommend two different stock funds. In order to select a better fund, the manager provides the following return history records of these two funds: Year 2017 2018 2019 2020 2021 2022 2023 Market Index Date Jan 1st, 2017 Jan 1st,2018 Fund A Fund B Net Asset Value at Return of Year Net Asset Value at year end (Million) year end (Million) Jan 1st, 2019 Jan 1st, 2020 Jan 1st, 2021 Jan 1st, 2022 Jan 1st, 2023 185.35 257.77 244.96 269.26 280.68 316.72 298.03 An investment Bank disclose the forecast of annual return on market index at the beginning of each year as the following table. Assume the T-bill annual rate is 1%. Expected Return 27.83% 39.07% -4.97% 9.92% 4.24% 12.84% -5.90% 20.63% 31.64% -4.40% 13.03% 6.11% 17.17% -7.05% Return of Year 2295.22 30.41% 3374.43 47.02% 3089.62 -8.44% 3396.12 9.92% 3585.62 5.58% 4037.05 12.59% 3890.10 -3.64%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started