Question

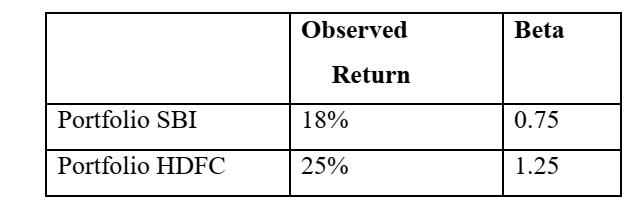

An investor was tracking SBI and HDFC mutual funds whose return and beta are as given below: Return on the market portfolio is 11%, while

An investor was tracking SBI and HDFC mutual funds whose return and beta are as given below:

Return on the market portfolio is 11%, while the risk-free return is 8%. Assume standard Deviation of the market to be 7%.

a. Compute the Jensen index for each of the funds and comment on which one is better.

b. Compute the Treynor index for each of the funds and comment on which one is better.

Step by Step Solution

3.45 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

a 1 Portfolio SBI 2 Portfolio HDFC Ans Jenson Index of portfolio SBI is ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Applied Corporate Finance

Authors: Aswath Damodaran

4th edition

978-1-118-9185, 9781118918562, 1118808932, 1118918568, 978-1118808931

Students also viewed these Corporate Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App