Answered step by step

Verified Expert Solution

Question

1 Approved Answer

An investor who is liable to 20% income tax is considering buying 1,000 shares of Goldmines PLC that pays annual dividends. The current dividend

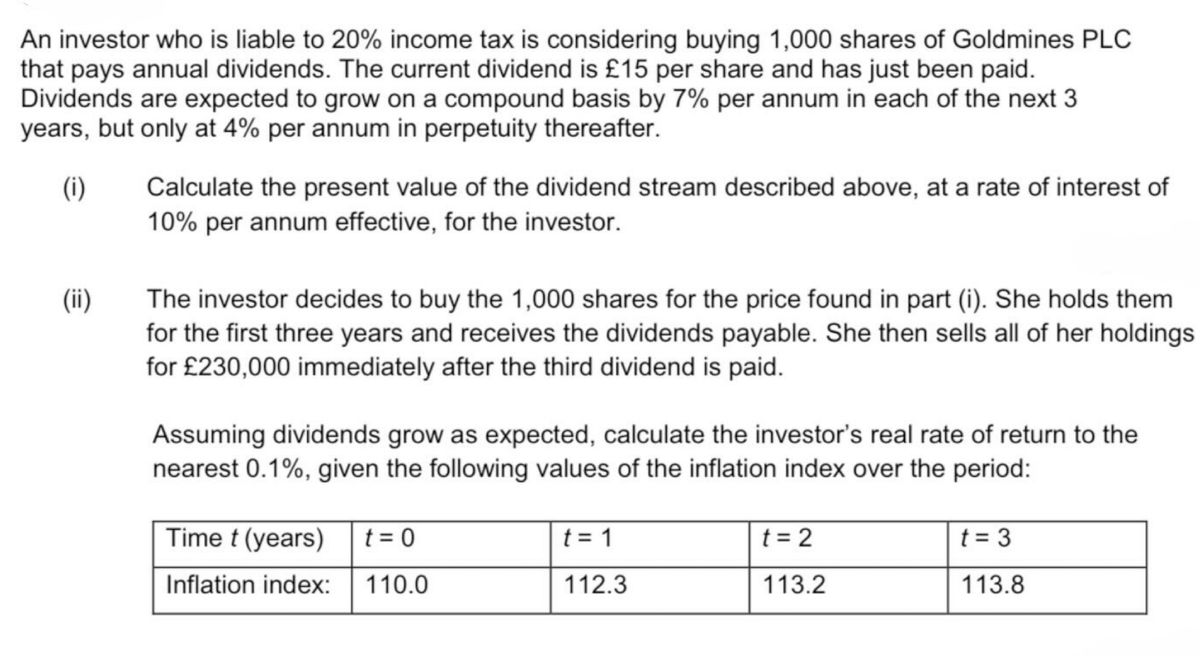

An investor who is liable to 20% income tax is considering buying 1,000 shares of Goldmines PLC that pays annual dividends. The current dividend is 15 per share and has just been paid. Dividends are expected to grow on a compound basis by 7% per annum in each of the next 3 years, but only at 4% per annum in perpetuity thereafter. (i) (ii) Calculate the present value of the dividend stream described above, at a rate of interest of 10% per annum effective, for the investor. The investor decides to buy the 1,000 shares for the price found in part (i). She holds them for the first three years and receives the dividends payable. She then sells all of her holdings for 230,000 immediately after the third dividend is paid. Assuming dividends grow as expected, calculate the investor's real rate of return to the nearest 0.1%, given the following values of the inflation index over the period: Time t (years) t=0 Inflation index: 110.0 t = 1 112.3 t = 2 113.2 t = 3 113.8

Step by Step Solution

★★★★★

3.50 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started