Answered step by step

Verified Expert Solution

Question

1 Approved Answer

An investor wishes to accumulate 12,000 in a fund at the end of 10 years. To accomplish this, she plans to make equal deposits of

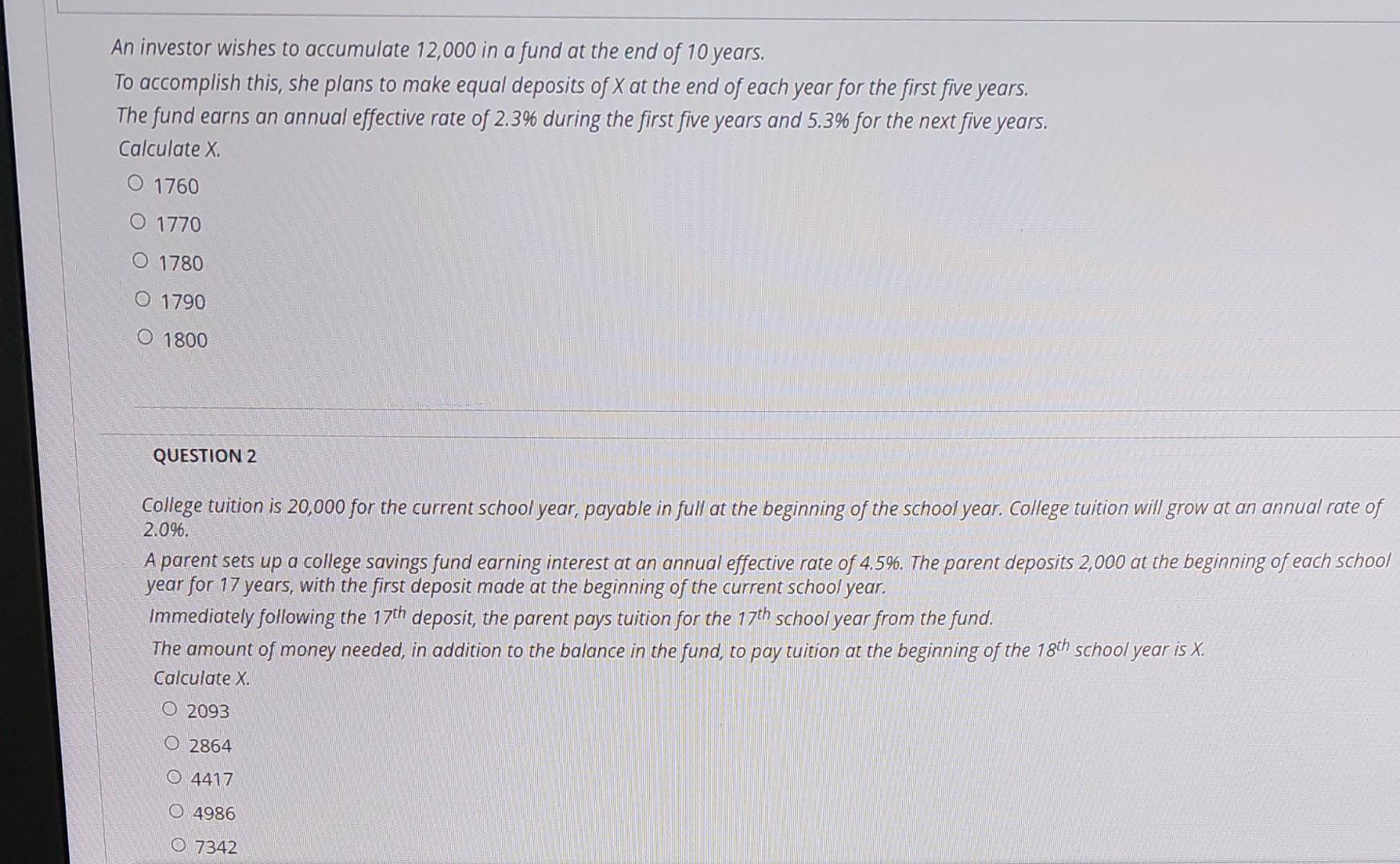

An investor wishes to accumulate 12,000 in a fund at the end of 10 years. To accomplish this, she plans to make equal deposits of X at the end of each year for the first five years. The fund earns an annual effective rate of 2.3% during the first five years and 5.3% for the next five years. Calculate X. 1760 1770 1780 1790 1800 QUESTION 2 College tuition is 20,000 for the current school year, payable in full at the beginning of the school year. College tuition will grow at an annual rate of 2.0%. A parent sets up a college savings fund earning interest at an annual effective rate of 4.5%. The parent deposits 2,000 at the beginning of each school year for 17 years, with the first deposit made at the beginning of the current school year. Immediately following the 17th deposit, the parent pays tuition for the 17th school year from the fund. The amount of money needed, in addition to the balance in the fund, to pay tuition at the beginning of the 18th school year is x. Calculate x 2093 2864 4417 4986 7342

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started