Question

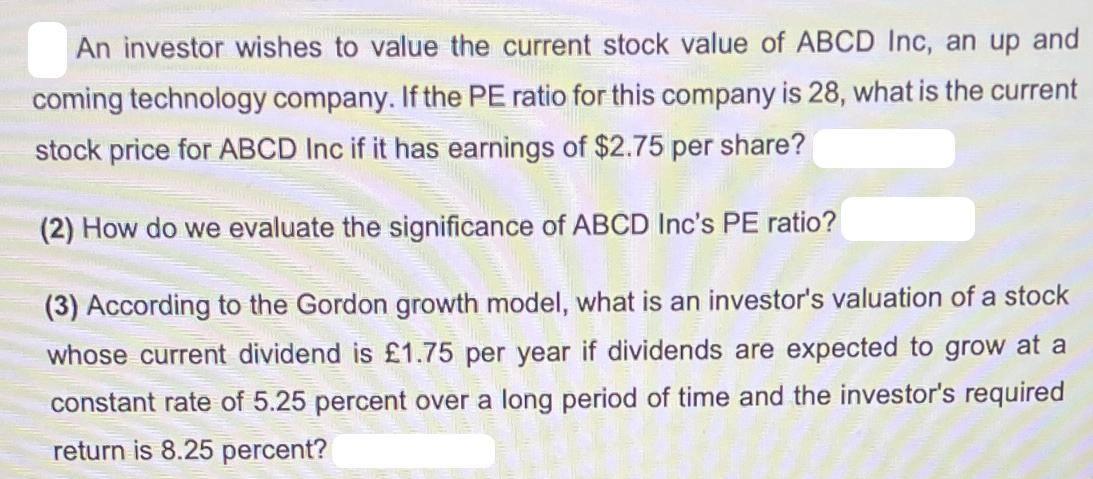

An investor wishes to value the current stock value of ABCD Inc, an up and coming technology company. If the PE ratio for this

An investor wishes to value the current stock value of ABCD Inc, an up and coming technology company. If the PE ratio for this company is 28, what is the current stock price for ABCD Inc if it has earnings of $2.75 per share? (2) How do we evaluate the significance of ABCD Inc's PE ratio? (3) According to the Gordon growth model, what is an investor's valuation of a stock whose current dividend is 1.75 per year if dividends are expected to grow at a constant rate of 5.25 percent over a long period of time and the investor's required return is 8.25 percent?

Step by Step Solution

3.41 Rating (167 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the current stock price of ABCD Inc we can use the PE ratio formula Stock Price PE Rati...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Managerial Decision Modeling With Spreadsheets

Authors: Nagraj Balakrishnan, Barry Render, Jr. Ralph M. Stair

3rd Edition

136115837, 978-0136115830

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App