Answered step by step

Verified Expert Solution

Question

1 Approved Answer

An investor with 2,500 to invest believes that Hanson stock will increase in value but is undecided whether to purchase Hanson stock, whether to

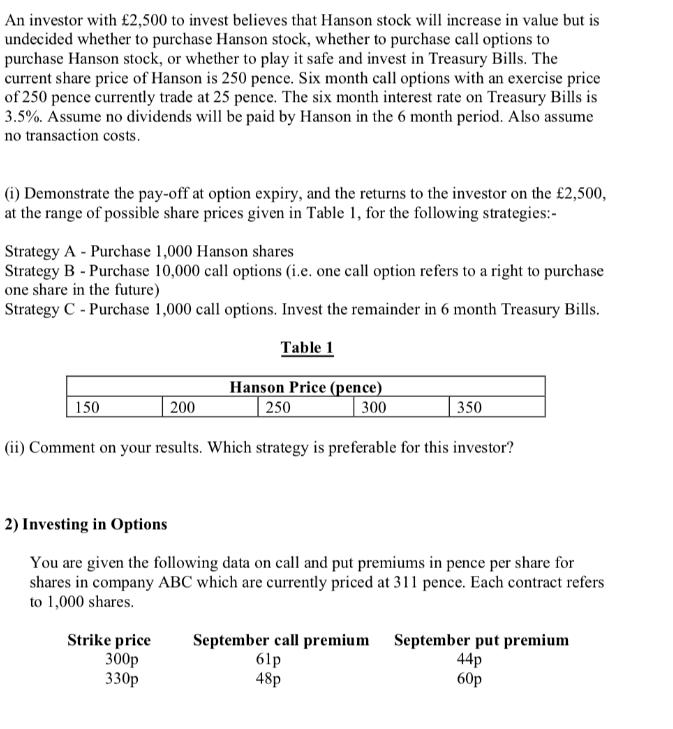

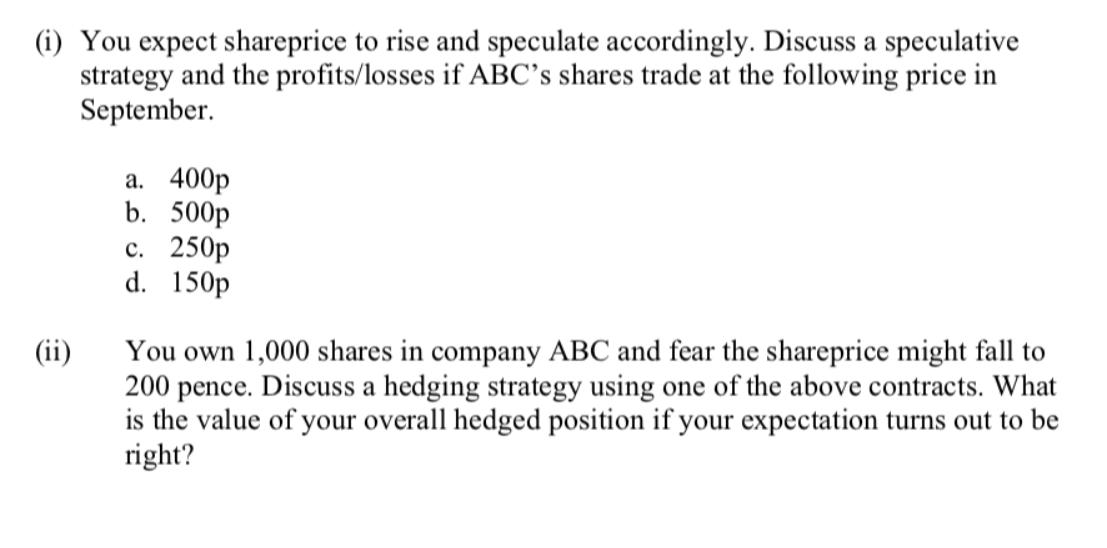

An investor with 2,500 to invest believes that Hanson stock will increase in value but is undecided whether to purchase Hanson stock, whether to purchase call options to purchase Hanson stock, or whether to play it safe and invest in Treasury Bills. The current share price of Hanson is 250 pence. Six month call options with an exercise price of 250 pence currently trade at 25 pence. The six month interest rate on Treasury Bills is 3.5%. Assume no dividends will be paid by Hanson in the 6 month period. Also assume no transaction costs. (i) Demonstrate the pay-off at option expiry, and the returns to the investor on the 2,500, at the range of possible share prices given in Table 1, for the following strategies:- Strategy A Purchase 1,000 Hanson shares Strategy B - Purchase 10,000 call options (i.e. one call option refers to a right to purchase one share in the future) Strategy C - Purchase 1,000 call options. Invest the remainder in 6 month Treasury Bills. Table 1 Hanson Price (pence) 250 300 (ii) Comment on your results. Which strategy is preferable for this investor? 150 200 Strike price 300p 330p 350 2) Investing in Options You are given the following data on call and put premiums in pence per share for shares in company ABC which are currently priced at 311 pence. Each contract refers to 1,000 shares. September call premium September put premium 44p 61p 48p 60p (i) You expect shareprice to rise and speculate accordingly. Discuss a speculative strategy and the profits/losses if ABC's shares trade at the following price in September. (ii) a. 400p b. 500p c. 250p d. 150p You own 1,000 shares in company ABC and fear the shareprice might fall to 200 pence. Discuss a hedging strategy using one of the above contracts. What is the value of your overall hedged position if your expectation turns out to be right?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

i Lets calculate the payoff at option expiry and the returns for each strategy given the range of possible share prices Strategy A Purchase 1000 Hanson shares Payoff If the share price is below 250 pe...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started