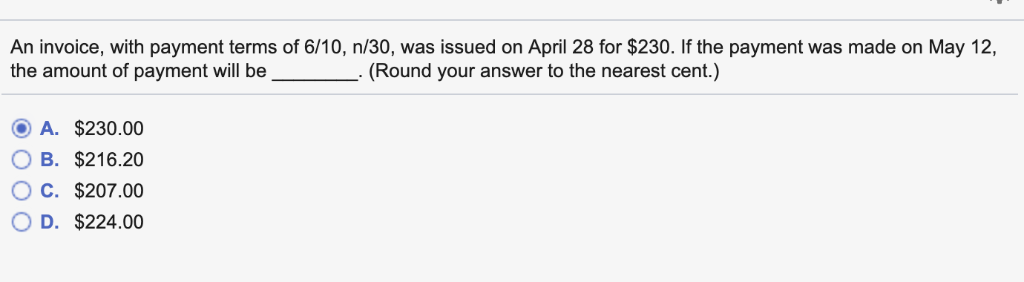

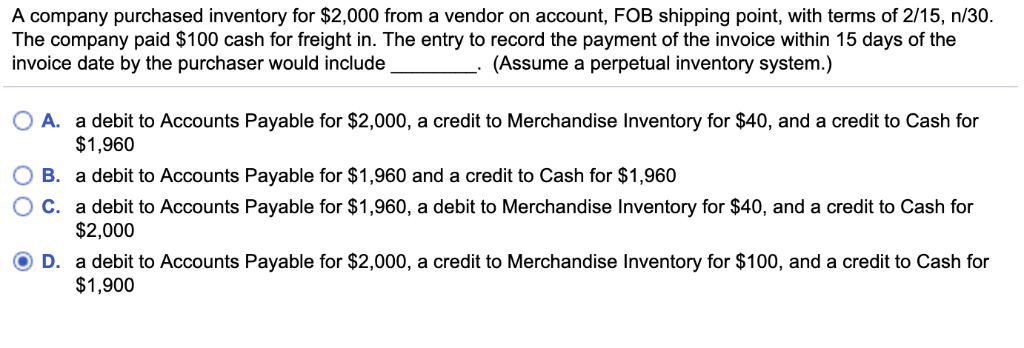

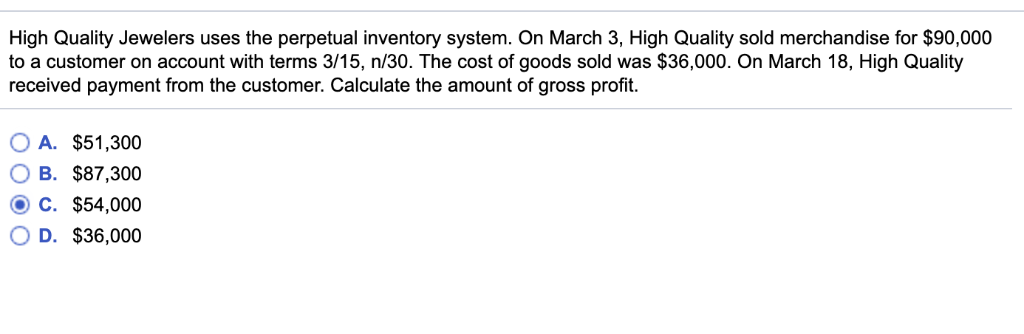

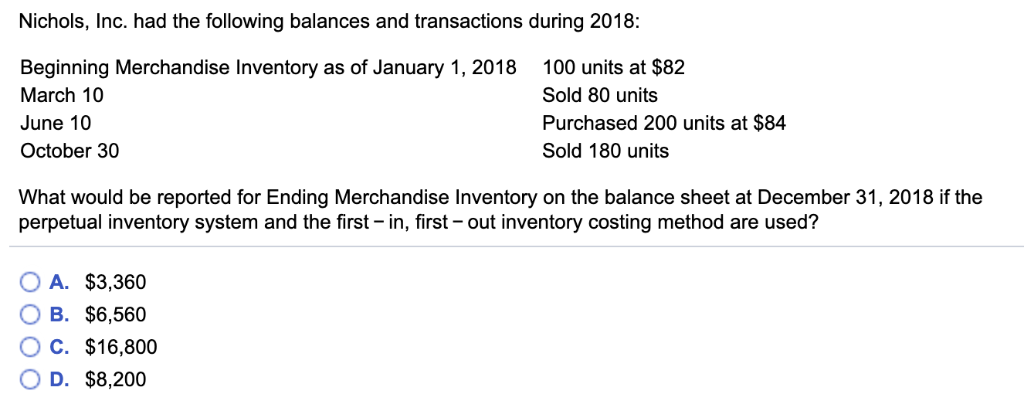

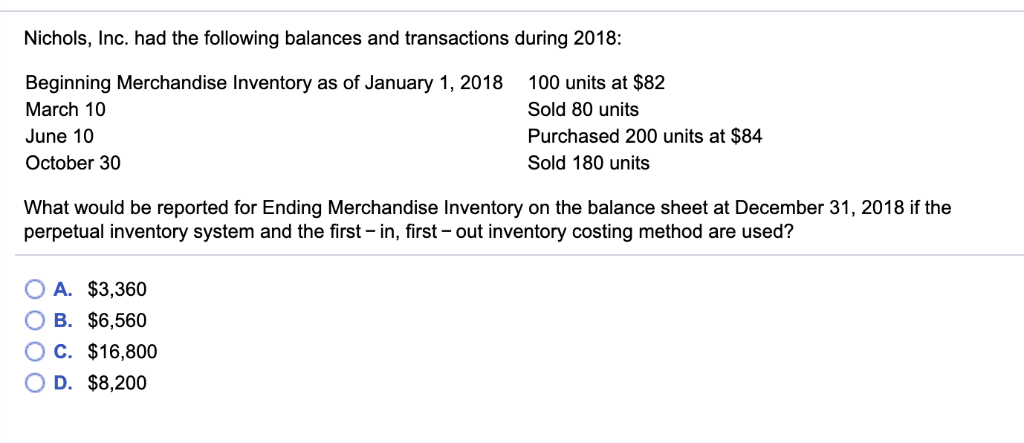

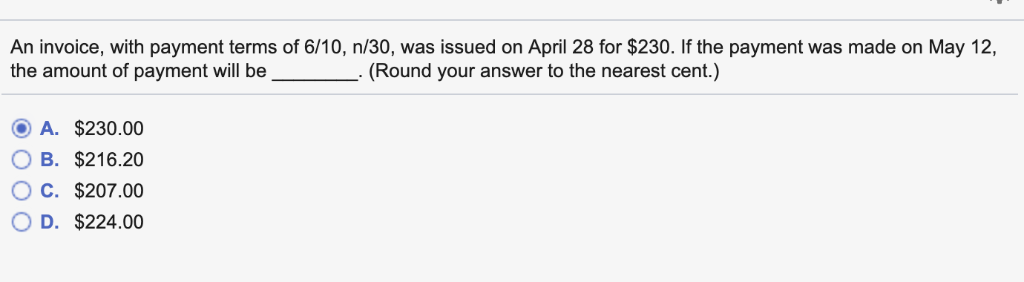

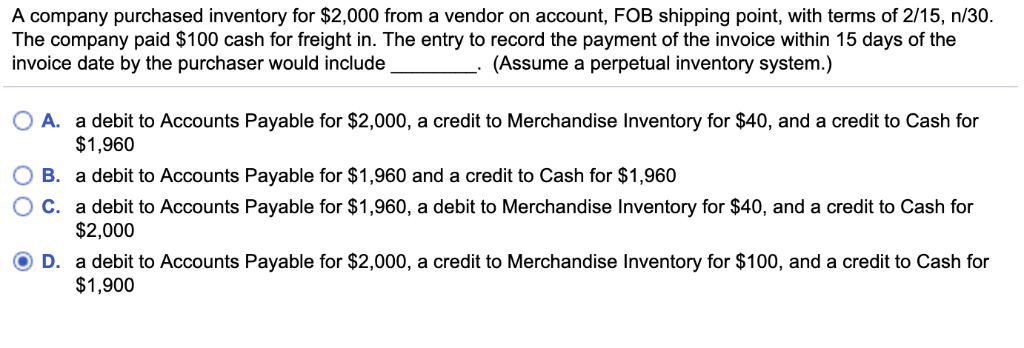

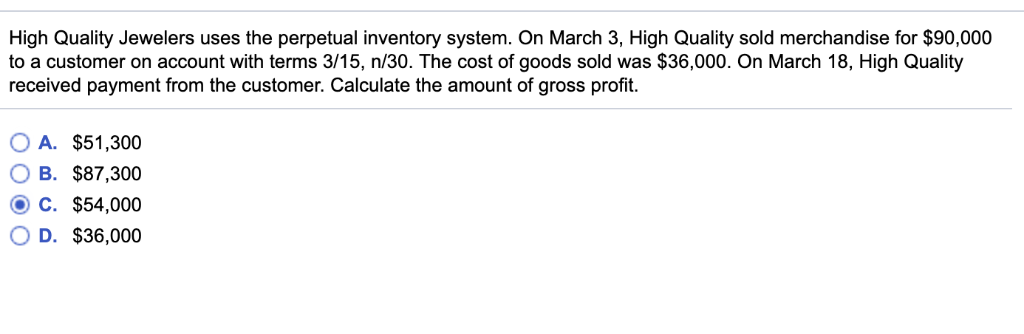

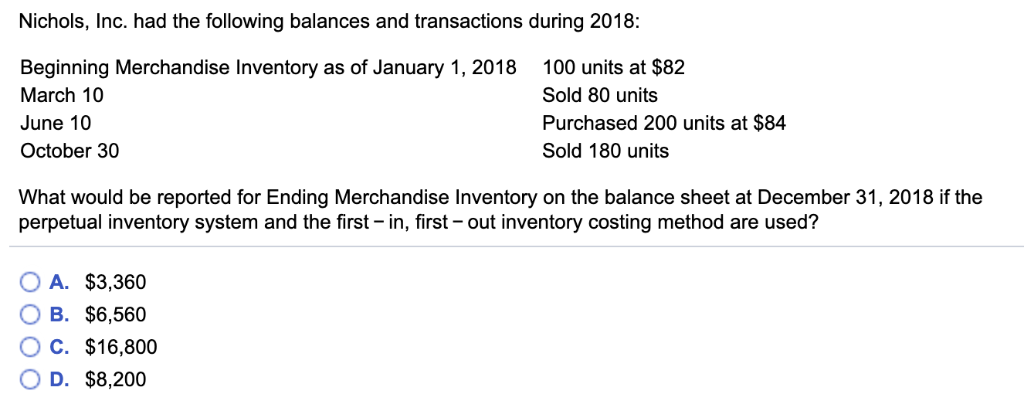

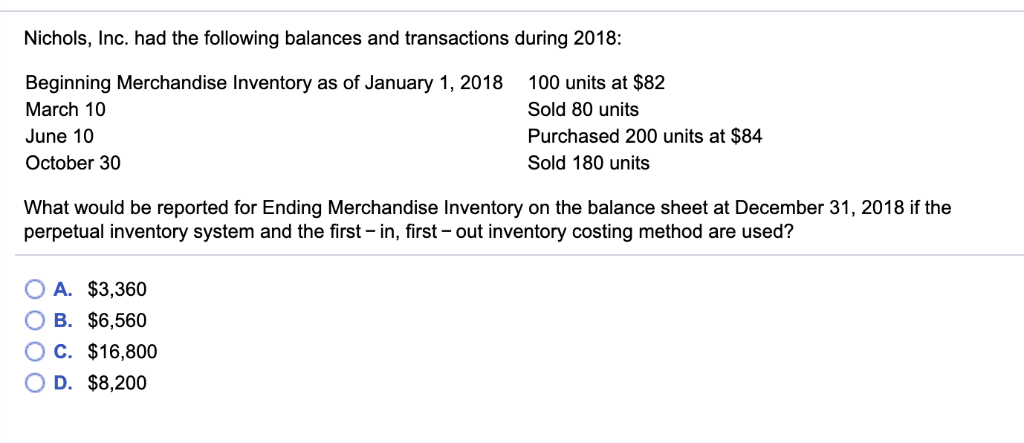

An invoice, with payment terms of 6/10, n/30, was issued on April 28 for $230. If the payment was made on May 12, the amount of payment will be (Round your answer to the nearest cent.) A. $230.00 B. $216.20 C. $207.00 D. $224.00 A company purchased inventory for $2,000 from a vendor on account, FOB shipping point, with terms of 2/15, n/30. The company paid $100 cash for freight in. The entry to record the payment of the invoice within 15 days of the invoice date by the purchaser would include (Assume a perpetual inventory system.) O A. a debit to Accounts Payable for $2,000, a credit to Merchandise Inventory for $40, and a credit to Cash for $1,960 O B. a debit to Accounts Payable for $1,960 and a credit to Cash for $1,960 C. a debit to Accounts Payable for $1,960, a debit to Merchandise Inventory for $40, and a credit to Cash for $2,000 O D. a debit to Accounts Payable for $2,000, a credit to Merchandise Inventory for $100, and a credit to Cash for $1,900 High Quality Jewelers uses the perpetual inventory system. On March 3, High Quality sold merchandise for $90,000 to a customer on account with terms 3/15, n/30. The cost of goods sold was $36,000. On March 18, High Quality received payment from the customer. Calculate the amount of gross profit. O A. $51,300 O B. $87,300 O C. $54,000 D. $36,000 Nichols, Inc. had the following balances and transactions during 2018: 100 units at $82 Beginning Merchandise Inventory as of January 1, 2018 Sold 80 units March 10 Purchased 200 units at $84 June 10 October 30 Sold 180 units What would be reported for Ending Merchandise Inventory on the balance sheet at December 31, 2018 if the perpetual inventory system and the first - in, first - out inventory costing method are used? O A. $3,360 O B. $6,560 O C. $16,800 O D. $8,200 Nichols, Inc. had the following balances and transactions during 2018: 100 units at $82 Beginning Merchandise Inventory as of January 1, 2018 March 10 Sold 80 units June 10 Purchased 200 units at $84 Sold 180 units October 30 What would be reported for Ending Merchandise Inventory on the balance sheet at December 31, 2018 if the perpetual inventory system and the first - in, first - out inventory costing method are used? O A. $3.360 O B. $6,560 O C. $16,800 O D. $8,200