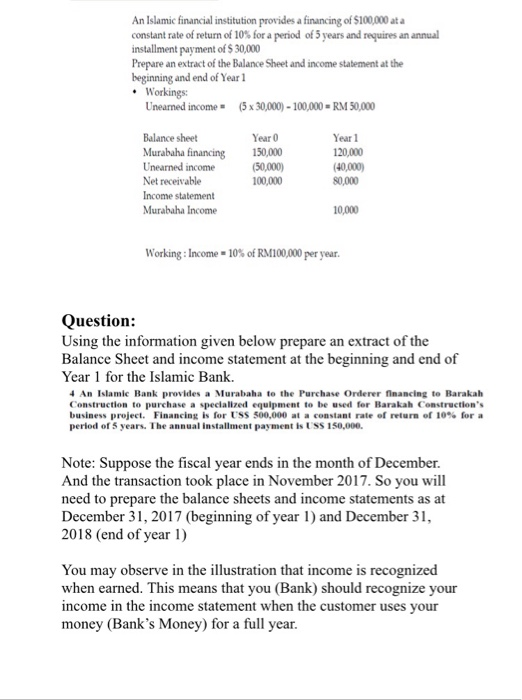

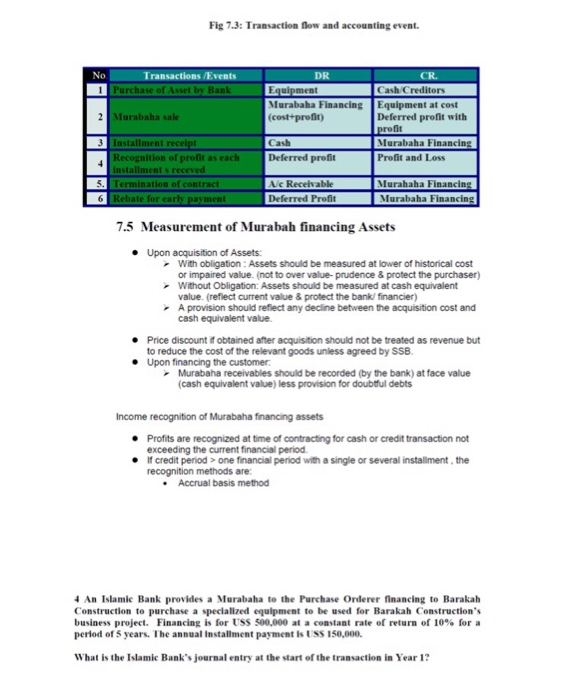

An Islamic financial institution provides a financing of $100,000 at a constant rate of return of 10% for a period of 5 years and requires an annual installment payment of $30,000 Prepare an extract of the Balance Sheet and income statement at the beginning and end of Year 1 Workings Uneared income (5x30,000) - 100,000 - RM 50,000 Balance sheet Murabaha financing Unearned income Net receivable Income statement Murabaha Income Year 0 150,000 (50,000) 100,000 Year 1 120,000 (40,000) 80,000 10,000 Working : Income = 10% of RM100,000 per year. Question: Using the information given below prepare an extract of the Balance Sheet and income statement at the beginning and end of Year 1 for the Islamic Bank. 4 An Islamic Bank provides a Murabaha to the Purchase Orderer financing to Barakah Construction to purchase a specialized equipment to be used for Barakah Construction's business project. Financing is for USS 500,000 at a constant rate of return of 10% for a period of 5 years. The annual installment payment is USS 150,000. Note: Suppose the fiscal year ends in the month of December. And the transaction took place in November 2017. So you will need to prepare the balance sheets and income statements as at December 31, 2017 (beginning of year 1) and December 31, 2018 (end of year 1) You may observe in the illustration that income is recognized when earned. This means that you (Bank) should recognize your income in the income statement when the customer uses your money (Bank's Money) for a full year. Fig 7.3: Transaction flow and accounting event. No. Transactions /Events Purchase of Asset by Bank Murabaha sale DR CR Equipment Cash/Creditors Murabaha Financing Equipment at cost (cost+profit) Deferred profit with profit Cash Murabaha Financing Deferred profit Profit and Loss 3 Installment receipt Recognition of profit as each Installment s receved 3. Termination of contract 6 Rebate for early payment Ac Receivable Deferred Profit Murahaha Financing Murabaha Financing 7.5 Measurement of Murabah financing Assets Upon acquisition of Assets With obligation : Assets should be measured at lower of historical cost or impaired value. (not to over value-prudence & protect the purchaser) - Without Obligation: Assets should be measured at cash equivalent value. (reflect current value & protect the bank/financier) A provision should reflect any decline between the acquisition cost and cash equivalent value Price discount if obtained after acquisition should not be treated as revenue but to reduce the cost of the relevant goods unless agreed by SSB Upon financing the customer. Murabaha receivables should be recorded by the bank) at face value (cash equivalent value) less provision for doubtful debts Income recognition of Murabaha financing assets Profits are recognized at time of contracting for cash or credit transaction not exceeding the current financial period If credit period > one financial period with a single or several installment, the recognition methods are: Accrual basis method 4 An Islamic Bank provides a Murabaha to the Purchase Orderer financing to Barakah Construction to purchase a specialized equipment to be used for Barakah Construction's business project. Financing is for USS 500.000 at a constant rate of return of 10% for a period of 5 years. The annual installment payment is USS 150,000. What is the Islamic Bank's journal entry at the start of the transaction in Year 1? An Islamic financial institution provides a financing of $100,000 at a constant rate of return of 10% for a period of 5 years and requires an annual installment payment of $30,000 Prepare an extract of the Balance Sheet and income statement at the beginning and end of Year 1 Workings Uneared income (5x30,000) - 100,000 - RM 50,000 Balance sheet Murabaha financing Unearned income Net receivable Income statement Murabaha Income Year 0 150,000 (50,000) 100,000 Year 1 120,000 (40,000) 80,000 10,000 Working : Income = 10% of RM100,000 per year. Question: Using the information given below prepare an extract of the Balance Sheet and income statement at the beginning and end of Year 1 for the Islamic Bank. 4 An Islamic Bank provides a Murabaha to the Purchase Orderer financing to Barakah Construction to purchase a specialized equipment to be used for Barakah Construction's business project. Financing is for USS 500,000 at a constant rate of return of 10% for a period of 5 years. The annual installment payment is USS 150,000. Note: Suppose the fiscal year ends in the month of December. And the transaction took place in November 2017. So you will need to prepare the balance sheets and income statements as at December 31, 2017 (beginning of year 1) and December 31, 2018 (end of year 1) You may observe in the illustration that income is recognized when earned. This means that you (Bank) should recognize your income in the income statement when the customer uses your money (Bank's Money) for a full year. Fig 7.3: Transaction flow and accounting event. No. Transactions /Events Purchase of Asset by Bank Murabaha sale DR CR Equipment Cash/Creditors Murabaha Financing Equipment at cost (cost+profit) Deferred profit with profit Cash Murabaha Financing Deferred profit Profit and Loss 3 Installment receipt Recognition of profit as each Installment s receved 3. Termination of contract 6 Rebate for early payment Ac Receivable Deferred Profit Murahaha Financing Murabaha Financing 7.5 Measurement of Murabah financing Assets Upon acquisition of Assets With obligation : Assets should be measured at lower of historical cost or impaired value. (not to over value-prudence & protect the purchaser) - Without Obligation: Assets should be measured at cash equivalent value. (reflect current value & protect the bank/financier) A provision should reflect any decline between the acquisition cost and cash equivalent value Price discount if obtained after acquisition should not be treated as revenue but to reduce the cost of the relevant goods unless agreed by SSB Upon financing the customer. Murabaha receivables should be recorded by the bank) at face value (cash equivalent value) less provision for doubtful debts Income recognition of Murabaha financing assets Profits are recognized at time of contracting for cash or credit transaction not exceeding the current financial period If credit period > one financial period with a single or several installment, the recognition methods are: Accrual basis method 4 An Islamic Bank provides a Murabaha to the Purchase Orderer financing to Barakah Construction to purchase a specialized equipment to be used for Barakah Construction's business project. Financing is for USS 500.000 at a constant rate of return of 10% for a period of 5 years. The annual installment payment is USS 150,000. What is the Islamic Bank's journal entry at the start of the transaction in Year 1