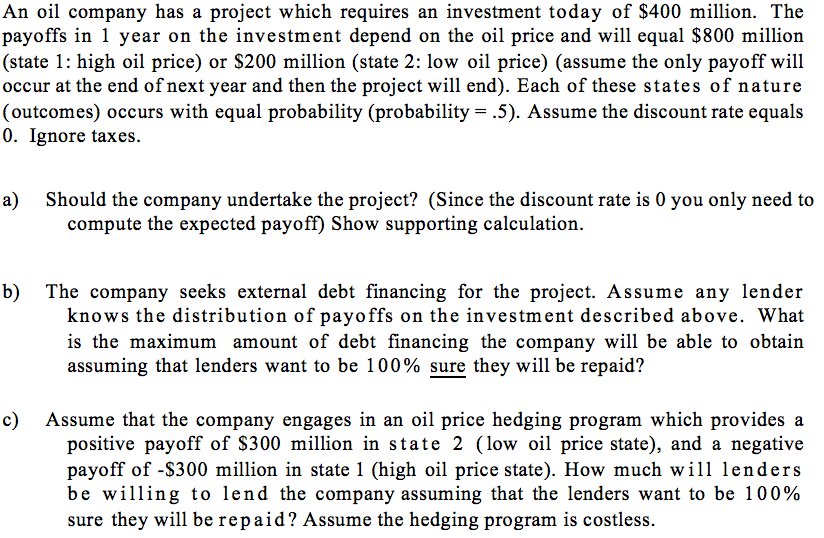

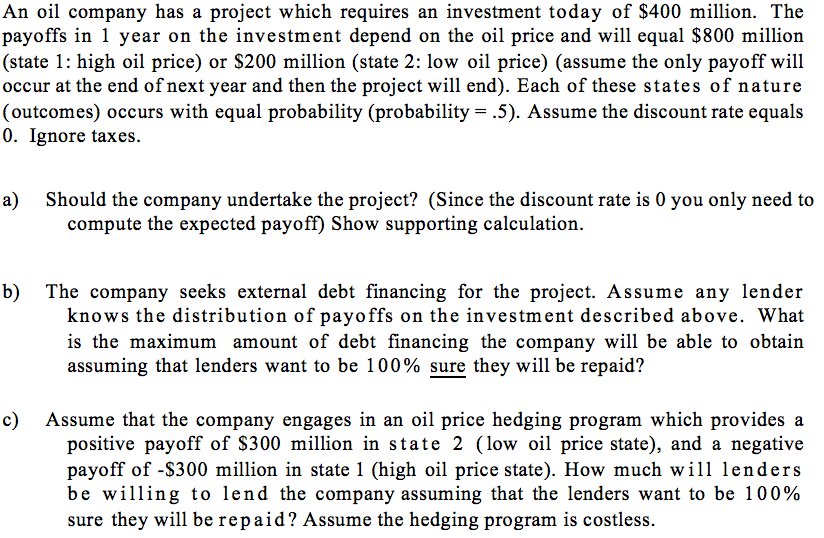

An oil company has a project which requires an investment today of $400 million. The payoffs in 1 year on the investment depend on the oil price and will equal $800 milion (state 1: high oil price) or S200 million (state 2: low oil price) (assume the only payoff will occur at the end of next year and then the project will end). Each of these states of nature (outcomes) occurs with equal probability (probability-.5). Assume the discount rate equals 0. Ignore taxes. a) Should the company undertake the project? (Since the discount rate is 0 you only need to compute the expected payoff) Show supporting calculation knows the distribution of payoffs on the investment described above. What is the maximum amount of debt financing the company will be able to obtain assuming that lenders want to be 100% sure they will be repaid? Assume that the company engages in an oil price hedging program which provides a c) positive payoff of S300 million in state 2 (low oil price state), and a negative payoff of -S300 million in state 1 (high oil price state). How much will lenders be willing to lend the company assuming that the lenders want to be 100% sure they will be repaid? Assume the hedging program is costless. An oil company has a project which requires an investment today of $400 million. The payoffs in 1 year on the investment depend on the oil price and will equal $800 milion (state 1: high oil price) or S200 million (state 2: low oil price) (assume the only payoff will occur at the end of next year and then the project will end). Each of these states of nature (outcomes) occurs with equal probability (probability-.5). Assume the discount rate equals 0. Ignore taxes. a) Should the company undertake the project? (Since the discount rate is 0 you only need to compute the expected payoff) Show supporting calculation knows the distribution of payoffs on the investment described above. What is the maximum amount of debt financing the company will be able to obtain assuming that lenders want to be 100% sure they will be repaid? Assume that the company engages in an oil price hedging program which provides a c) positive payoff of S300 million in state 2 (low oil price state), and a negative payoff of -S300 million in state 1 (high oil price state). How much will lenders be willing to lend the company assuming that the lenders want to be 100% sure they will be repaid? Assume the hedging program is costless