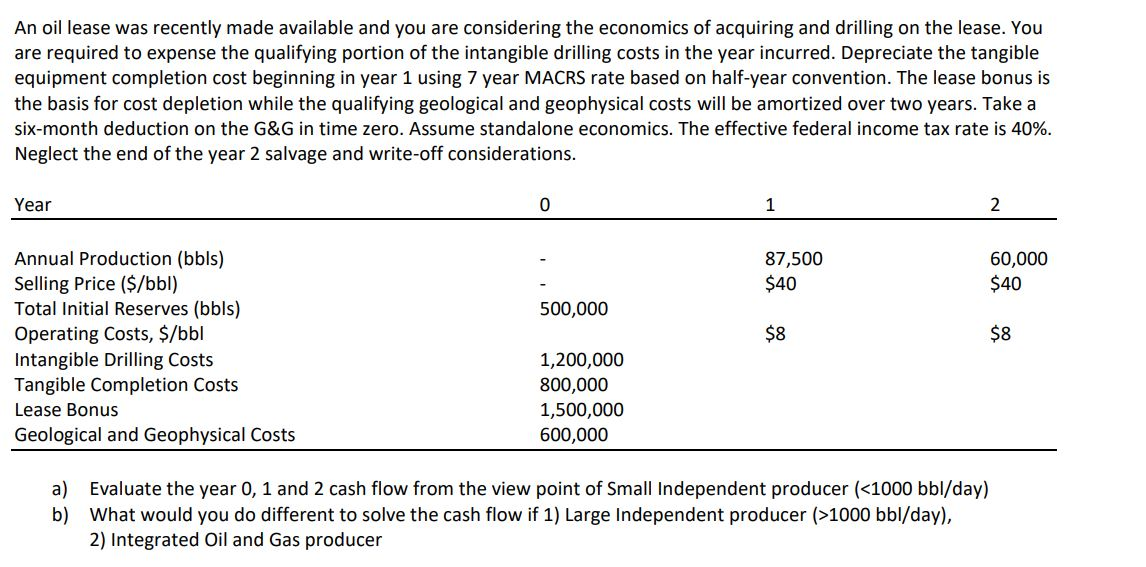

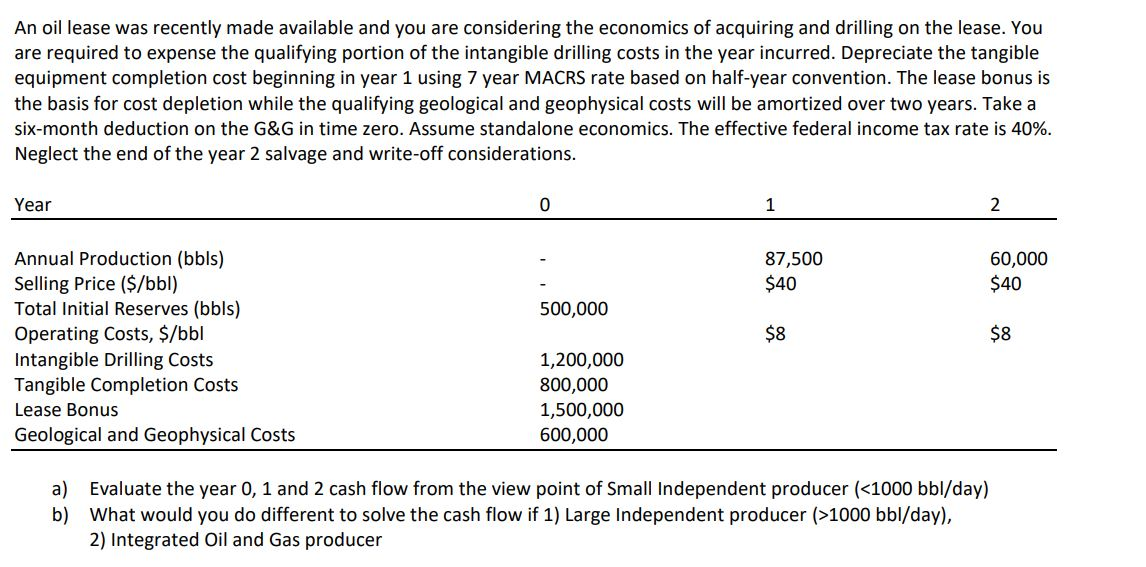

An oil lease was recently made available and you are considering the economics of acquiring and drilling on the lease. You are required to expense the qualifying portion of the intangible drilling costs in the year incurred. Depreciate the tangible equipment completion cost beginning in year 1 using 7 year MACRS rate based on half-year convention. The lease bonus is the basis for cost depletion while the qualifying geological and geophysical costs will be amortized over two years. Take a six-month deduction on the G&G in time zero. Assume standalone economics. The effective federal income tax rate is 40%. Neglect the end of the year 2 salvage and write-off considerations. Year 87,500 $40 60,000 $40 500,000 Annual Production (bbls) Selling Price ($/bbl) Total Initial Reserves (bbls) Operating costs, $/bbl Intangible Drilling Costs Tangible Completion Costs Lease Bonus Geological and Geophysical Costs $8 $8 1,200,000 800,000 1,500,000 600,000 a) Evaluate the year 0, 1 and 2 cash flow from the view point of Small Independent producer (1000 bbl/day), 2) Integrated Oil and Gas producer An oil lease was recently made available and you are considering the economics of acquiring and drilling on the lease. You are required to expense the qualifying portion of the intangible drilling costs in the year incurred. Depreciate the tangible equipment completion cost beginning in year 1 using 7 year MACRS rate based on half-year convention. The lease bonus is the basis for cost depletion while the qualifying geological and geophysical costs will be amortized over two years. Take a six-month deduction on the G&G in time zero. Assume standalone economics. The effective federal income tax rate is 40%. Neglect the end of the year 2 salvage and write-off considerations. Year 87,500 $40 60,000 $40 500,000 Annual Production (bbls) Selling Price ($/bbl) Total Initial Reserves (bbls) Operating costs, $/bbl Intangible Drilling Costs Tangible Completion Costs Lease Bonus Geological and Geophysical Costs $8 $8 1,200,000 800,000 1,500,000 600,000 a) Evaluate the year 0, 1 and 2 cash flow from the view point of Small Independent producer (1000 bbl/day), 2) Integrated Oil and Gas producer