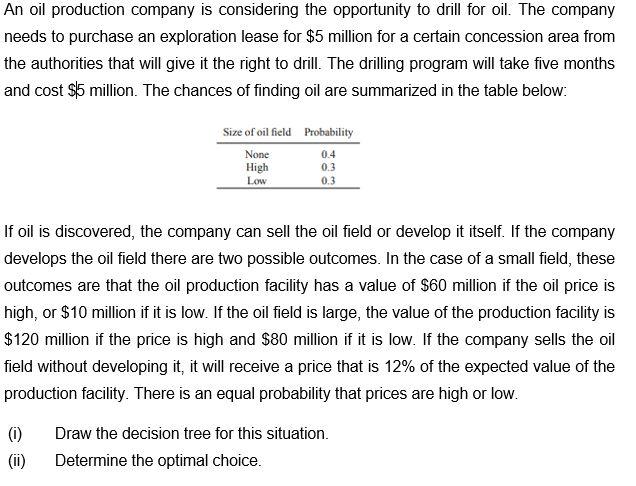

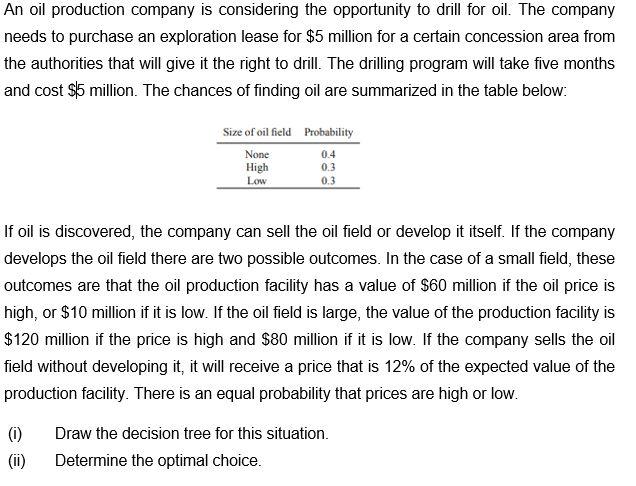

An oil production company is considering the opportunity to drill for oil. The company needs to purchase an exploration lease for $5 million for a certain concession area from the authorities that will give it the right to drill. The drilling program will take five months and cost $5 million. The chances of finding oil are summarized in the table below: Size of oil field Probability None 0.4 High 0.3 Low 0.3 If oil is discovered, the company can sell the oil fie or develop it itself. If the company develops the oil field there are two possible outcomes. In the case of a small field, these outcomes are that the oil production facility has a value of $60 million if the oil price is high, or $10 million if it is low. If the oil field is large, the value of the production facility is $120 million if the price is high and $80 million if it is low. If the company sells the oil field without developing it, it will receive a price that is 12% of the expected value of the production facility. There is an equal probability that prices are high or low. (0) (ii) Draw the decision tree for this situation. Determine the optimal choice. An oil production company is considering the opportunity to drill for oil. The company needs to purchase an exploration lease for $5 million for a certain concession area from the authorities that will give it the right to drill. The drilling program will take five months and cost $5 million. The chances of finding oil are summarized in the table below: Size of oil field Probability None 0.4 High 0.3 Low 0.3 If oil is discovered, the company can sell the oil fie or develop it itself. If the company develops the oil field there are two possible outcomes. In the case of a small field, these outcomes are that the oil production facility has a value of $60 million if the oil price is high, or $10 million if it is low. If the oil field is large, the value of the production facility is $120 million if the price is high and $80 million if it is low. If the company sells the oil field without developing it, it will receive a price that is 12% of the expected value of the production facility. There is an equal probability that prices are high or low. (0) (ii) Draw the decision tree for this situation. Determine the optimal choice