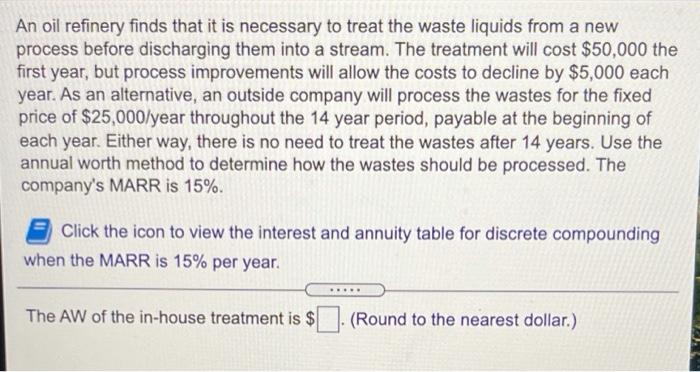

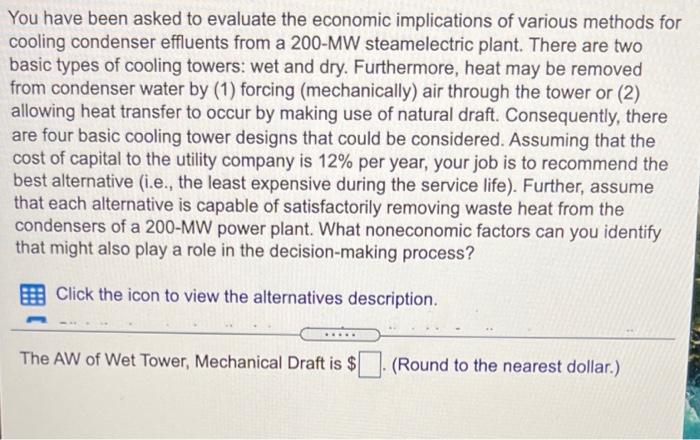

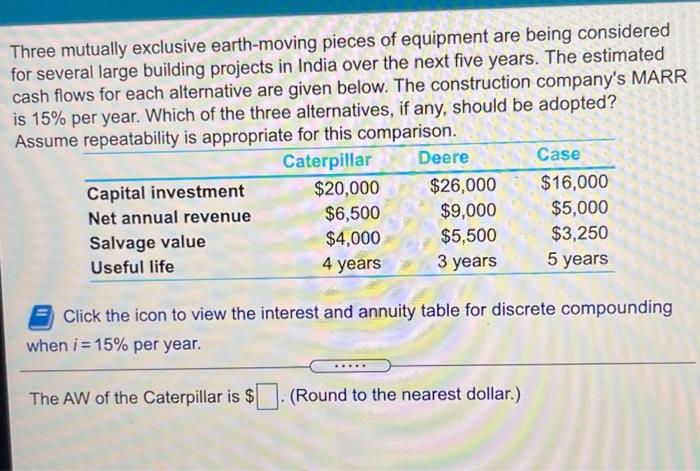

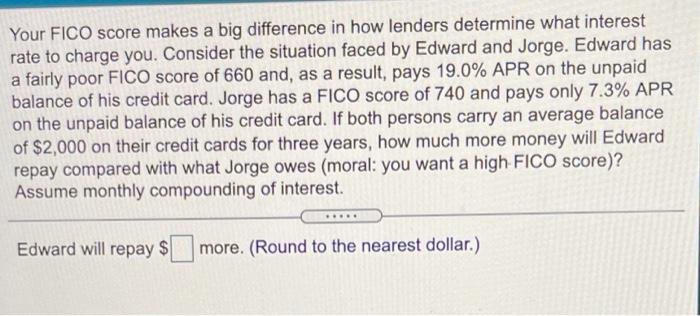

An oil refinery finds that it is necessary to treat the waste liquids from a new process before discharging them into a stream. The treatment will cost $50,000 the first year, but process improvements will allow the costs to decline by $5,000 each year. As an alternative, an outside company will process the wastes for the fixed price of $25,000/year throughout the 14 year period, payable at the beginning of each year. Either way, there is no need to treat the wastes after 14 years. Use the annual worth method to determine how the wastes should be processed. The company's MARR is 15%. Click the icon to view the interest and annuity table for discrete compounding when the MARR is 15% per year. The AW of the in-house treatment is $ (Round to the nearest dollar.) You have been asked to evaluate the economic implications of various methods for cooling condenser effluents from a 200-MW steamelectric plant. There are two basic types of cooling towers: wet and dry. Furthermore, heat may be removed from condenser water by (1) forcing (mechanically) air through the tower or (2) allowing heat transfer to occur by making use of natural draft. Consequently, there are four basic cooling tower designs that could be considered. Assuming that the cost of capital to the utility company is 12% per year, your job is to recommend the best alternative (i.e., the least expensive during the service life). Further, assume that each alternative is capable of satisfactorily removing waste heat from the condensers of a 200-MW power plant. What noneconomic factors can you identify that might also play a role in the decision-making process? Click the icon to view the alternatives description. The AW of Wet Tower, Mechanical Draft is $ (Round to the nearest dollar.) Three mutually exclusive earth-moving pieces of equipment are being considered for several large building projects in India over the next five years. The estimated cash flows for each alternative are given below. The construction company's MARR is 15% per year. Which of the three alternatives, if any, should be adopted? Assume repeatability is appropriate for this comparison. Caterpillar Deere Case Capital investment $20,000 $26,000 $16,000 Net annual revenue $6,500 $9,000 $5,000 Salvage value $4,000 $5,500 $3,250 Useful life 4 years 3 years 5 years Click the icon to view the interest and annuity table for discrete compounding when i = 15% per year. The AW of the Caterpillar is $ (Round to the nearest dollar.) Your FICO score makes a big difference in how lenders determine what interest rate to charge you. Consider the situation faced by Edward and Jorge. Edward has a fairly poor FICO score of 660 and, as a result, pays 19.0% APR on the unpaid balance of his credit card. Jorge has a FICO score of 740 and pays only 7.3% APR on the unpaid balance of his credit card. If both persons carry an average balance of $2,000 on their credit cards for three years, how much more money will Edward repay compared with what Jorge owes (moral: you want a high FICO score)? Assume monthly compounding of interest. Edward will repay $ more. (Round to the nearest dollar.)